How to E-File Form 990-N (e-Postcard)

Using ExpressTaxExempt

All you need is to follow the step-by-step guide mentioned below to quickly prepare & e-file your Form 990-N directly to the IRS.

-

Create an Account

If you have not registered, click on the "NEW USERS" button as a new users. Otherwise, click "RETURNING USERS" button.

Once you have logged in or registered, proceed to Step 2 on the e-Postcard home page to create your Form 990-N (see below).

-

Adding your Exempt Organization details

Enter your Exempt Organization details such as Organization Name, Employer Identification Number (EIN) and Address.

The Organization name and EIN must match exactly as the IRS has it in their system.

-

Choose your Tax Year & Tax Period

Select the tax year for which you are filing the return. We support current tax year 2020 and Prior Tax Years 2019 & 2018.

-

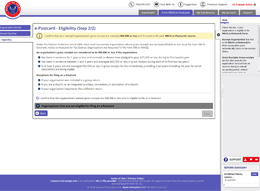

Confirm your Eligibility criteria

This page shows information about the eligibility criteria for filing 990-N e-Postcard and also about the organizations who are not eligible to e-file Form 990-N.

To e-file e-Postcard 990-N with IRS you need to confirm your gross receipt is $50,000 or less.

-

Review

Here you will find the sum of your return. Please verify the data for accuracy. To change any value click the "Edit" button next to it. Click the "Review" button for our internal error checks.

-

Audit Summary

In this page, our application will do an audit check and help you to find the errors. You can fix the errors before proceeding to transmit to the IRS. However, if there are no errors on the page, then you can proceed further to electronically transmit it to the IRS.

-

Transmit to the IRS

After completing these above processes you can transmit your Form 990-N (e-Postcard) to the IRS.

Most Recent Blogs

Need Further Help? Contact Us

Our live support specialists in Rock Hill, SC are always ready to offer professional service and assistance.

Frequently Asked Questions

Find answers related to e-filing IRS Form 990-N (e-Postcard), 990-EZ, 990, 990-PF, Form 1120-POL and Extension Form 8868 with our Frequently Asked Questions.

Blogs

Stay updated with the latest news, features, and industry trends around ExpressTaxExempt.