E-file IRS Form 1120-POL Online

Securely Prepare and E-File Form 1120-POL with ExpressTaxExempt

Why E-File Form 1120-POL with ExpressTaxExempt?

- Invite Users to Manage Filing

- Retransmit Rejected Returns for FREE

- Free First Amendment for original return filed with us

- Supports Amended Return

- U.S based Chat, Email, & Phone Support

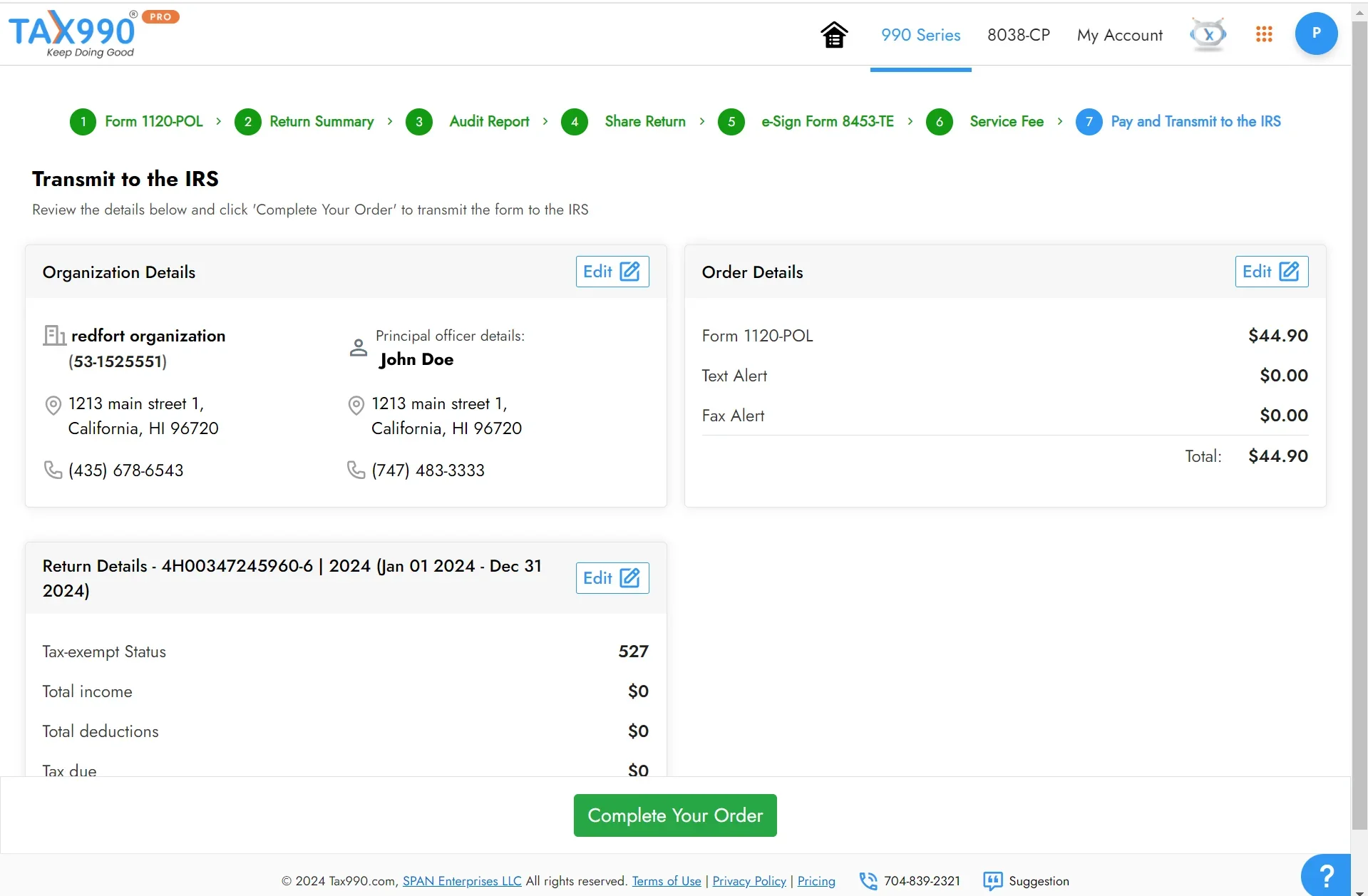

How to e-file Form 1120-POL?

See why our clients choose ExpressTaxExempt!

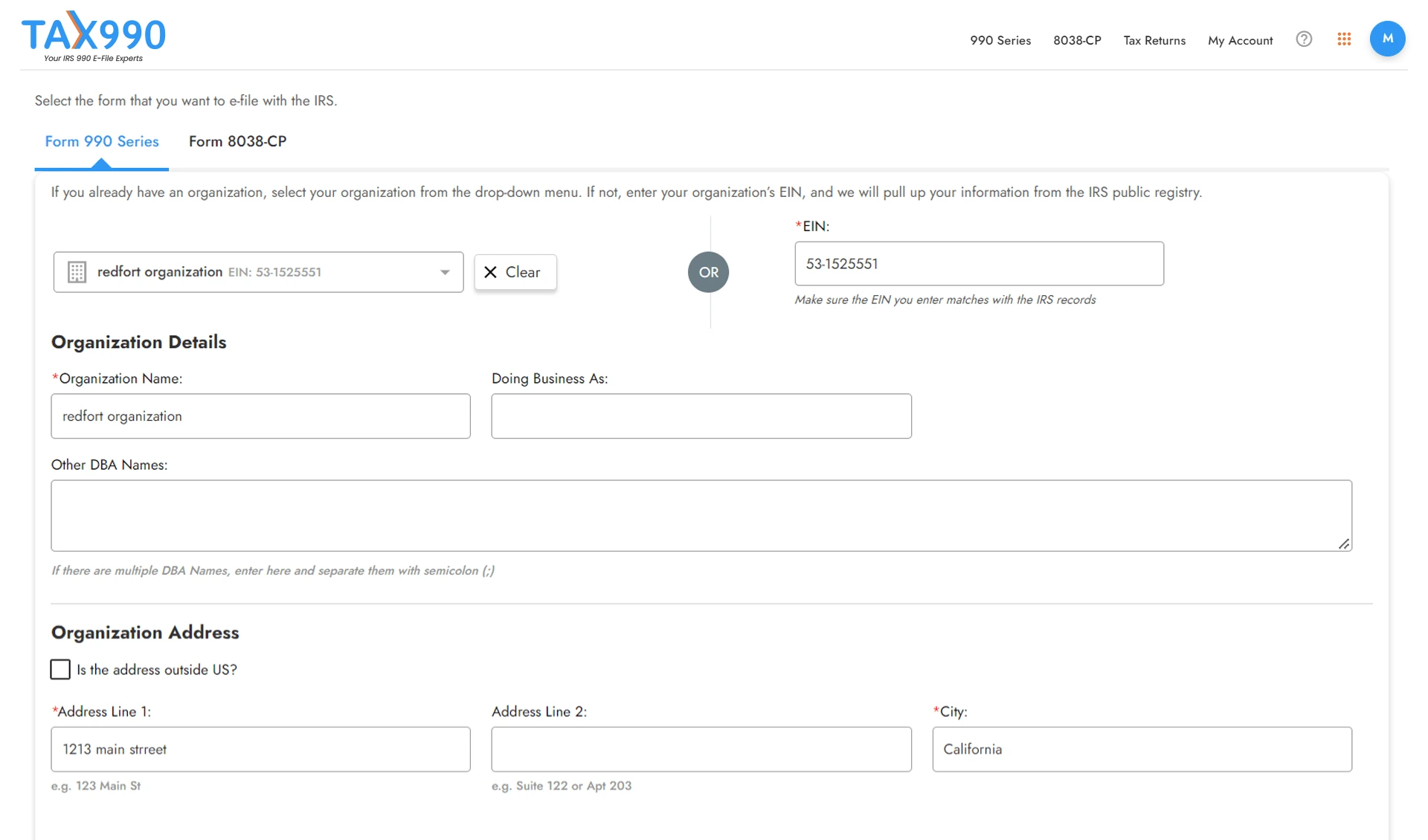

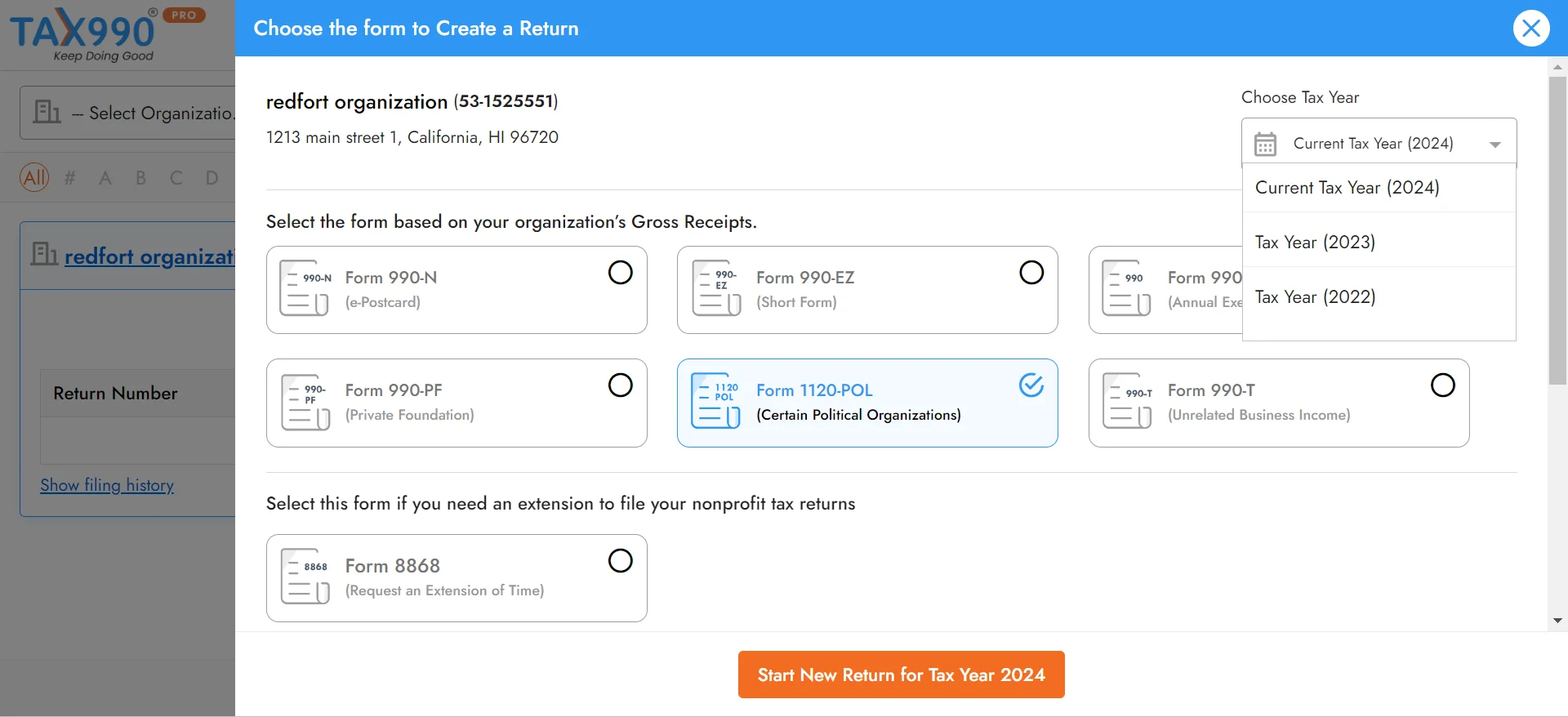

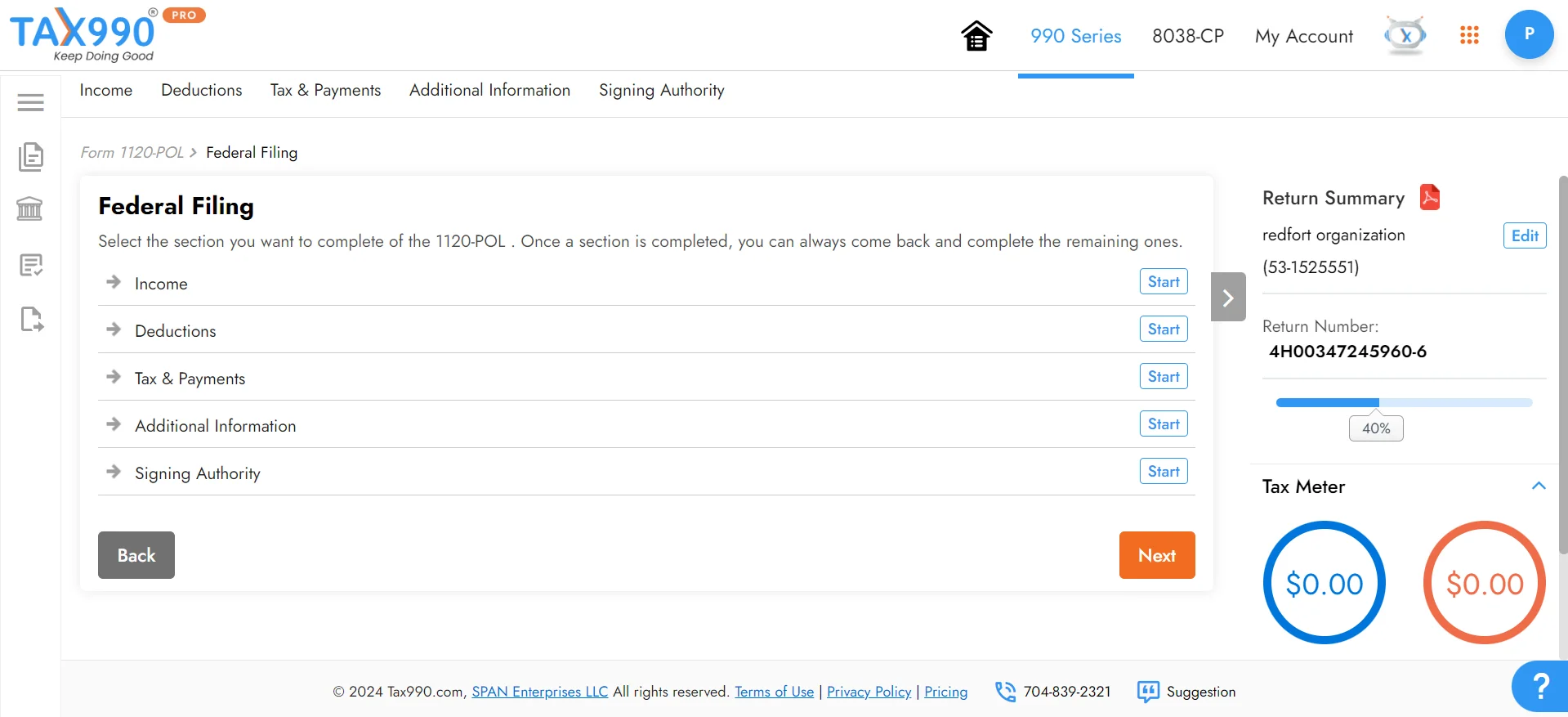

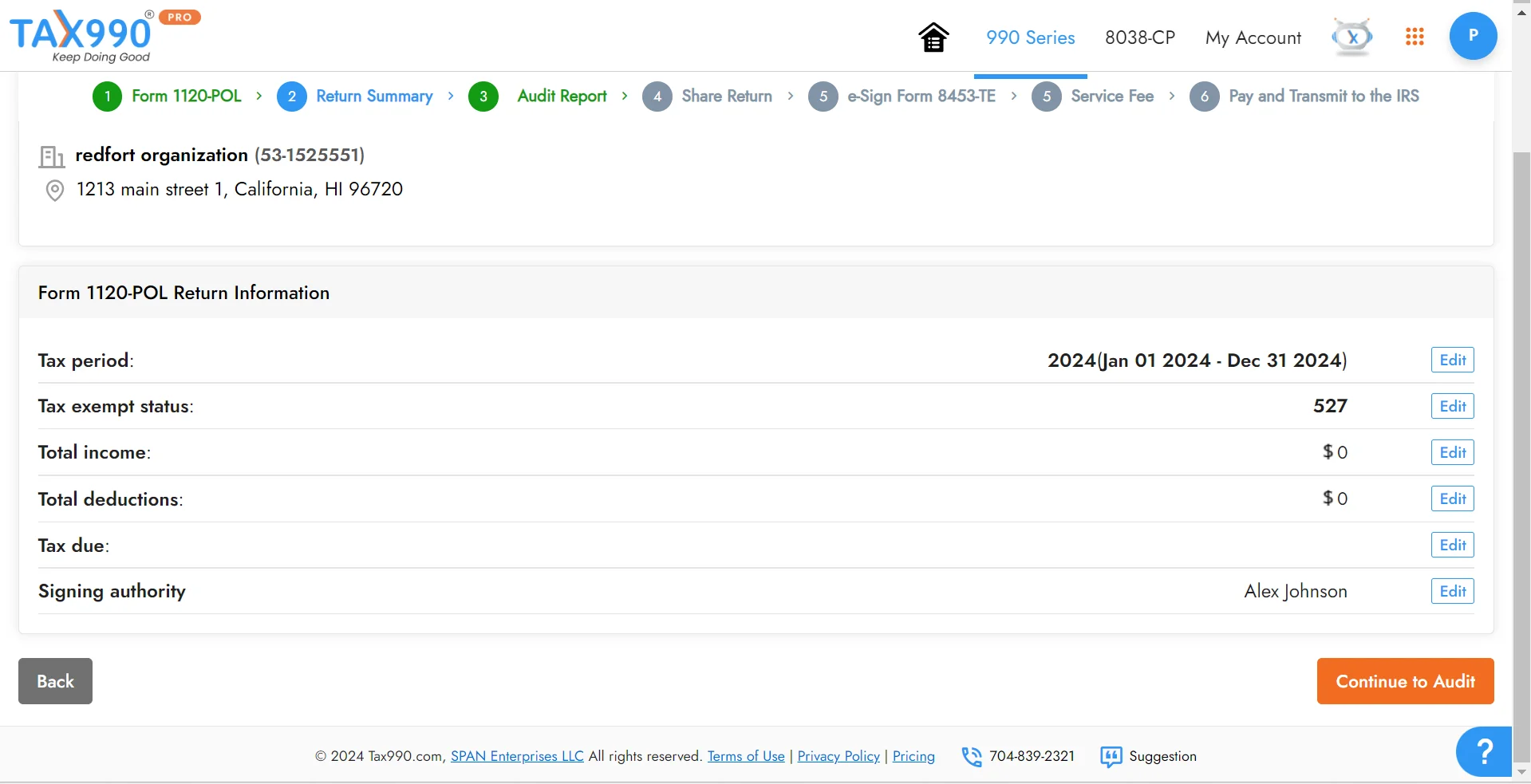

How to E-file Form 1120-POL Online for the 2024 Tax Year

with ExpressTaxExempt

Ready to File Your Form 1120-POL Electronically?

Why E-file Form 1120-POL Online with ExpressTaxExempt?

Prepare your form easily using Interview-style filing

Ensure accurate return with our internal audit check

Add and manage additional users to assist while filing

Re-transmit rejected

1120-POL Forms for free

E-file an amended Form

1120-POL return securely

Get your queries resolved by our live support team

Ready to e-file Form 1120-POL with ExpressTaxExempt?

Form 1120-POL Amended Return

Need to correct information on your previously filed Form 1120-POL?

You can easily e-file an amended return with ExpressTaxExempt and update information from a previously filed return. When filing an amended return, you will need to provide a reason for why you need to change your Form 1120-POL.

Note: Organizations that need to e-file an amended Form 1120-POL return must have e-filed their original return through ExpressTaxExempt

Frequently Asked Question on Form 1120-POL

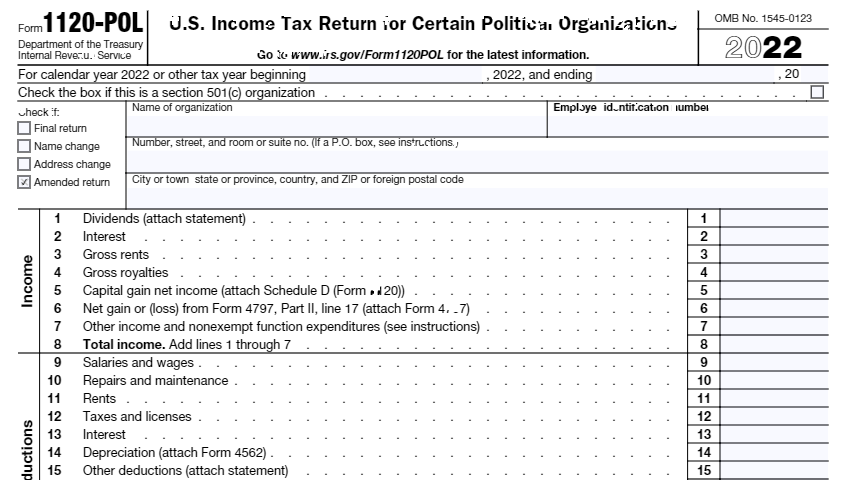

What is IRS Form 1120-POL?

Form 1120-POL is an annual income tax return that must be filed by organizations with political organization taxable income exceeding $100 for the taxable year.

Only taxable income (generally, the organization's investment income) is reported on Form 1120-POL.

When is the due date to file Form 1120-POL?

Form 1120-POL must be filed before the 15th day of 4th month after the organization tax year ends. For the organizations that operate on a calendar tax year, must file Form 1120-POL by April 15. E-file Now

How to file an extension for Form 1120-POL?

If needed, you may file Form 7004 to get an automatic 6 month extension to file your Form 1120-POL. You must file Form 7004 before the original Form 1120-POL filing due date to get the extension.

What are the late filing penalties for Form 1120-POL?

Organizations that fail to file Form 1120-POL before their deadline must pay an additional amount equal to 5% of the tax due for each month the return is late. The maximum penalty for late filing of Form 1120-POL is 25% of the tax due; the minimum penalty for a return more than 60 days late is the smaller of the tax due or $135.

Recent Queries

- Is it mandatory to fill out schedules when filing Form 990?

- Can I switch the filing method from form-based to interview-based or vice-versa mid-way?

- Can I save my return and come back later to complete my form?

- How do I download my 990 return?

- Can I review the form before transmitting it to the IRS?