E-File IRS Form 990 Online

Simplify your Form 990 Filing with Live Customer Support from ExpressTaxExempt

Why E-File Form 990 with ExpressTaxExempt?

-

Direct Form Entry or Interview Style

Filing Process - Includes 990 Schedules

- Supports Form 990-T

- Internal Audit Check

- Free First Amendment for original return filed with us.

- Retransmit Rejected Returns for FREE

View Pricing

How to E-file Form 990 Online for the 2024 Tax Year

with ExpressTaxExempt?

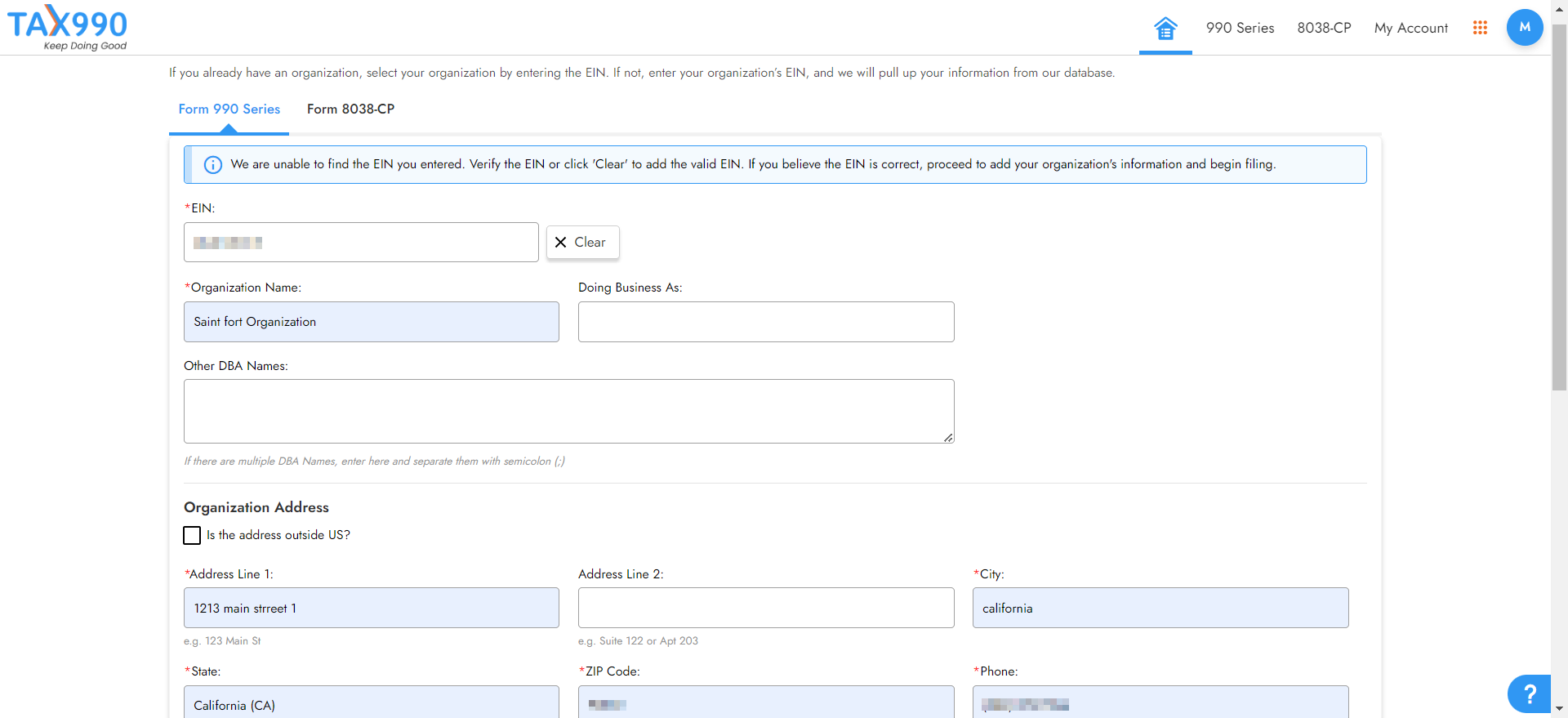

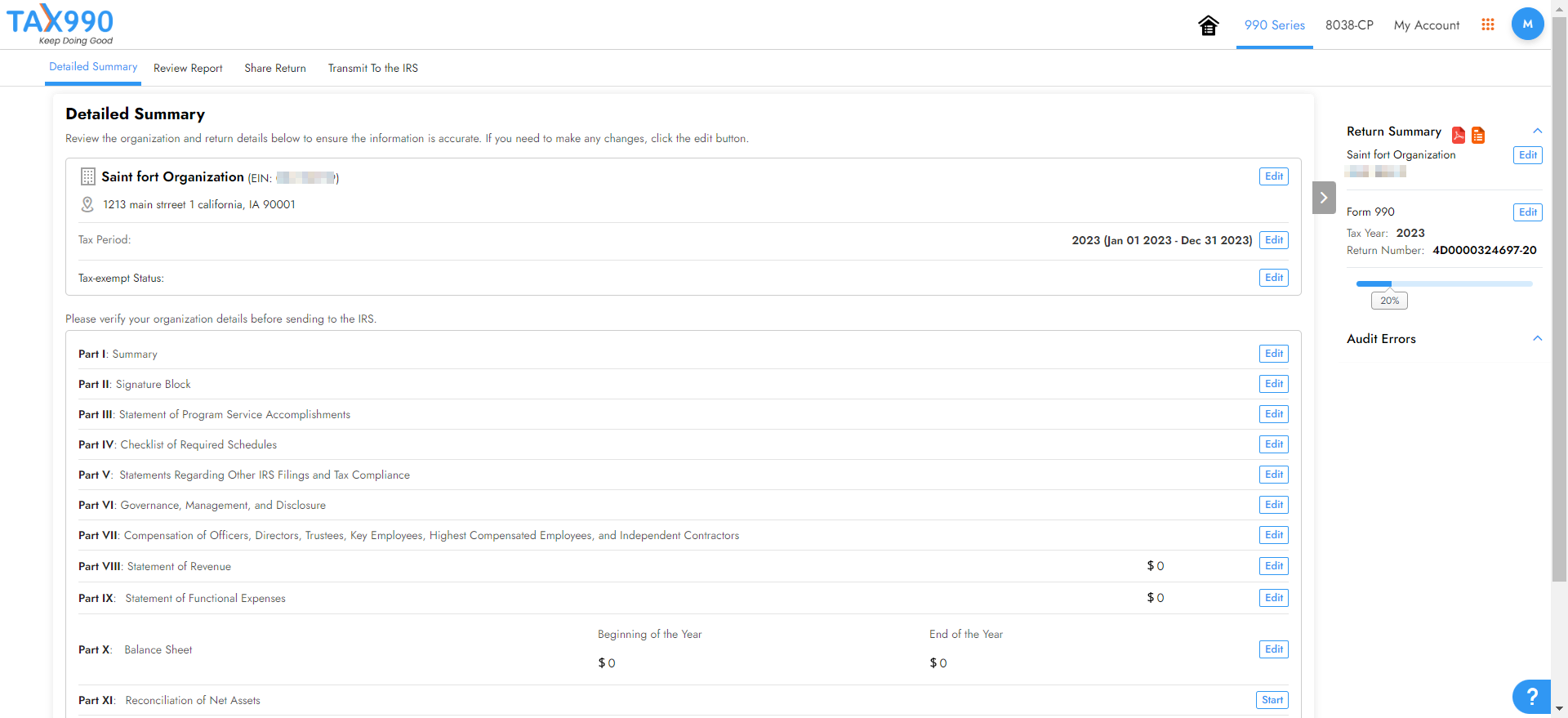

Search for your EIN, and our system will import your organization’s data from the IRS database. You can also enter your organization’s details manually.

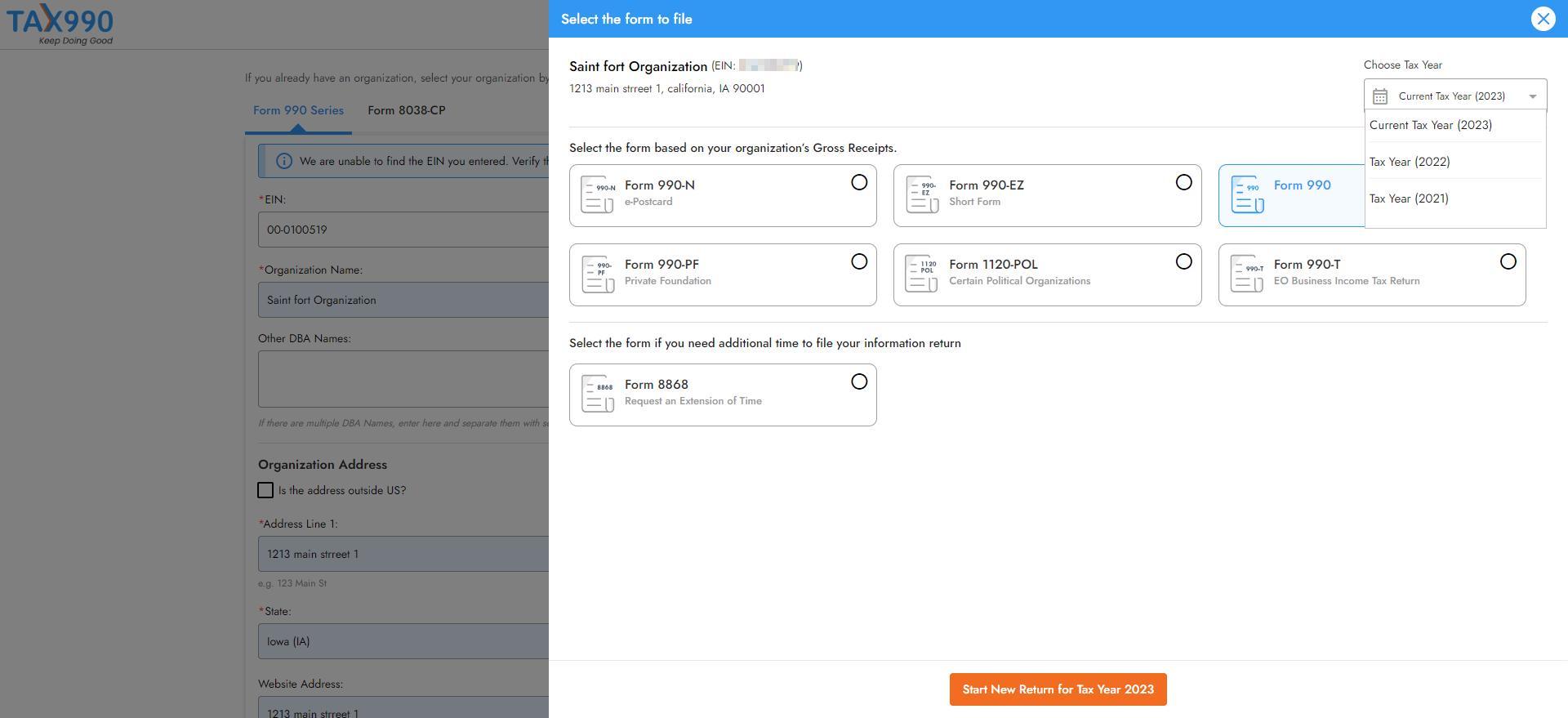

Choose the tax year for which you want to file a return and proceed. ExpressTaxExempt supports the current and the previous year's filing.

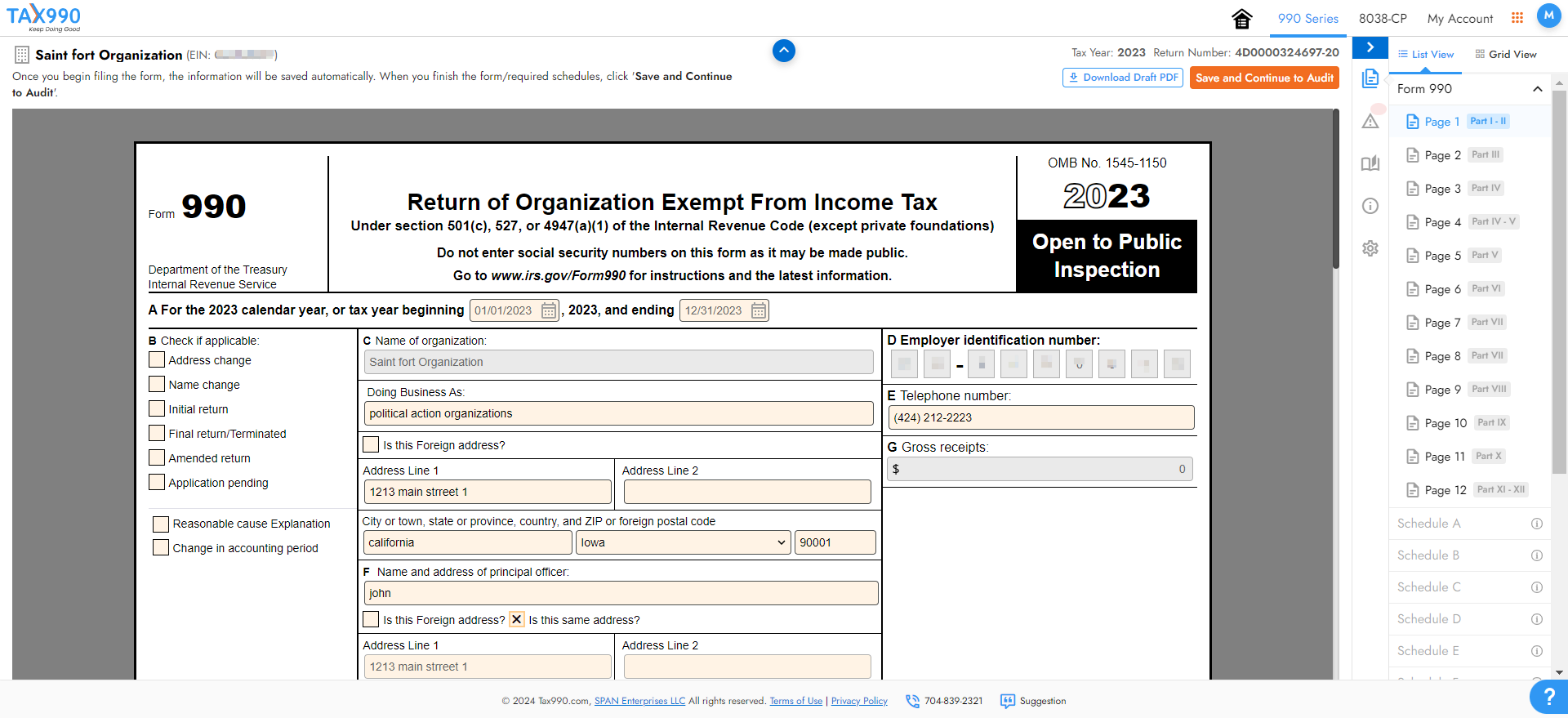

We provide a Form-based and Interview-Style filing option for 990. Choose your preferred method and provide the required form information.

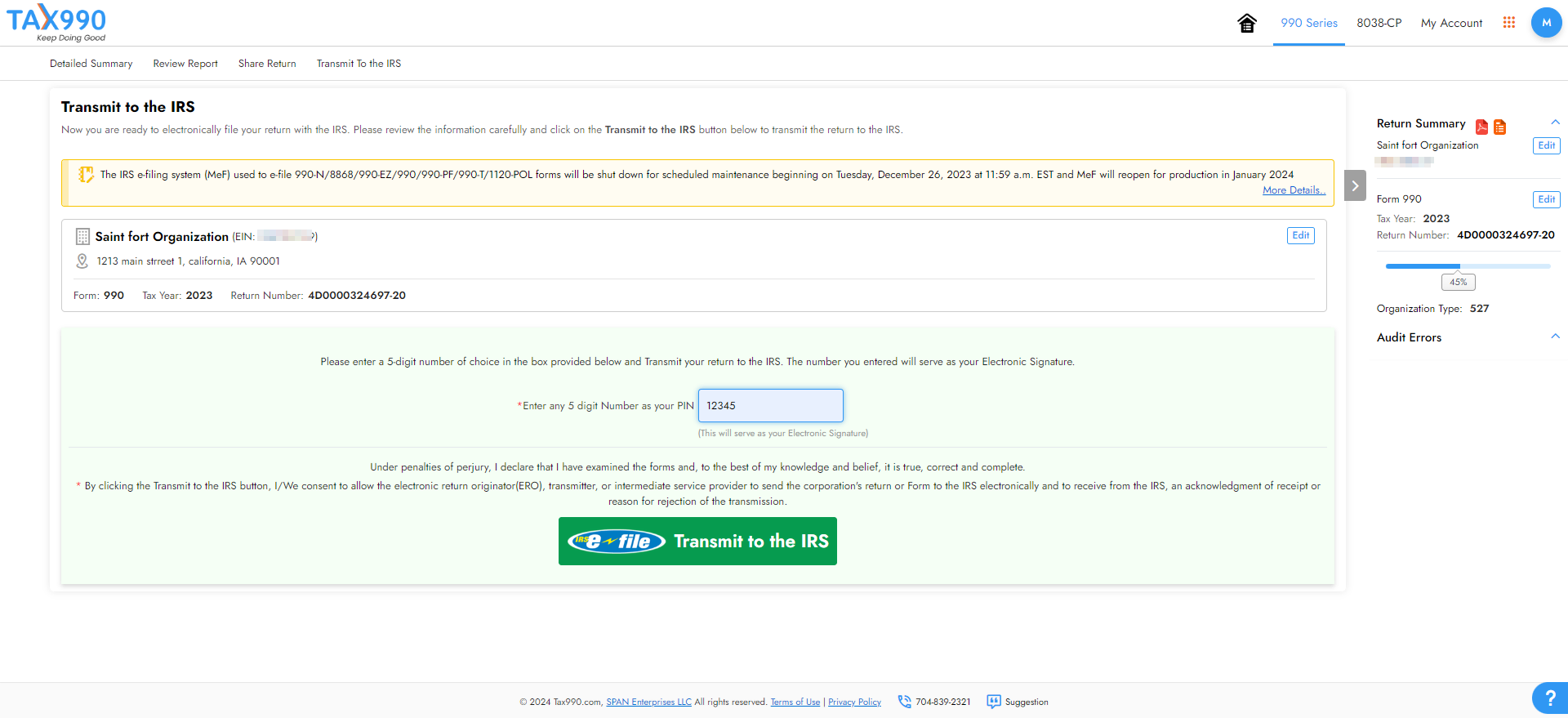

You can review the summary of your form. Also, you can share your form with other organization members to review and approve the return.

Once you have reviewed the form, you can transmit it to the IRS. Our system keeps you updated with the status of your form via email and text.

Ready to File Your Form 990 Electronically?

Why E-file Form 990 with ExpressTaxExempt?

Prepare forms using form based or interview-style

Includes almost all the 990 Schedules

Copy Data from your Prior year Return

Add and manage staff to assist in form preparation

Internal Audit check for error-free filing

Invite Users to Review and Approve your 990 Return

Supports e-filing of Extension Form 8868

Supports Form 990 Amended Return

Access to knowledge base, chat, Email, & Phone Support

See why our clients choose ExpressTaxExempt!

Form 990 Schedules

Schedules are FREE while filing your 990 Form with our Software.Form 990 requires additional information forms called Schedules to be filed along with each 990 return. In total, there are 16 Schedules available for Form 990, and organizations must file the correct Schedules depending upon their activities.

When filing your Form 990 return with ExpressTaxExempt , the applicable schedules will be auto-generated based on the information you provided on the return.

Form 990 Amended Returns

If you need to make a correction on a previously filed 990 return, you can do so with ExpressTaxExempt . You can easily view our previous return, correct the necessary information and re-transmit your return to the IRS.

Note: You can amend the 990 return with us, even if your original return was filed with the other service providers.

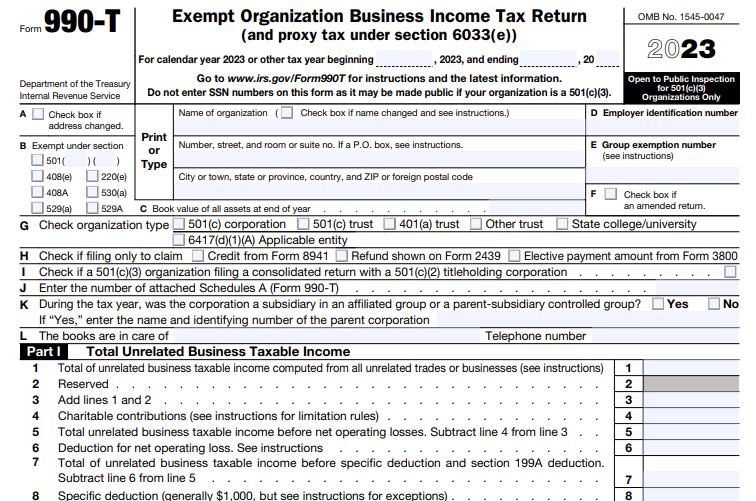

Reporting Unrelated Business Income on Form 990-T

Any tax-exempt organization that generates an annual gross income of $1000 or more through business activities unrelated to their tax-exempt purpose should report that information to the IRS by filing Form 990-T.

ExpressTaxExempt also supports the filing of Form 990-T. Learn More

Frequently Asked Question on Form 990

What is IRS Form 990?

Form 990 is typically filed by Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations to provide the information required by section 6033.

Organizations with gross receipts greater than or equal to $200,000 or total assets greater than or equal to $500,000 at the end of the tax year must e-file Form 990 Form 990.

When is the deadline to file my Form 990?

File Form 990 by the 15th day of the 5th month after the accounting period ends. Use the Due Date Calculator to find your form 990 filing deadline if your organization follows fiscal tax year.

If your organization follows the calendar tax year, then the deadline for the 2024 tax year is May 15.

Can Form 990 be filed electronically?

Yes, IRS Form 990 can be filed electronically. Choose an authorized provider such as tax990.com to e-file your nonprofit tax forms securely.

Note: The Taxpayer First Act, enacted July 1, requires tax-exempt organizations to file all the 990 and related forms electronically. i.e., organizations tax year beginning after July 2019 must file their 990 returns electronically.