IRS Form 990 Schedule O Instructions

This article further explores the following points:

Form 990 Schedule O - Supplemental Information to Form 990 or 990-EZ

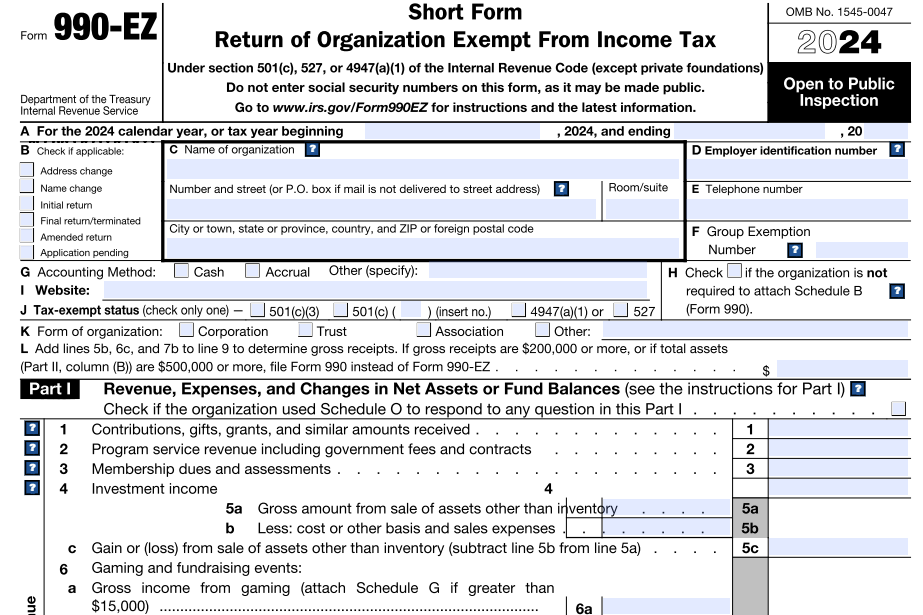

- Updated December 06, 2024 - 8.00 AM - Admin, ExpressTaxExemptForm 990/990-EZ Schedule O is used by Nonprofits & tax-exempt Organizations to report the narrative information that is required for specific questions on Form 990 or 990-EZ.

Also, the organization is required to provide an explanation in the schedule to various questions mentioned in the form.

Table of Contents

1. Who must file Form 990 Schedule O?

Schedule O, Supplemental Information is attached by organizations that file Form 990 (answers to Part VI lines 11b and 19) and certain organizations filing 990-EZ.

If an organization voluntarily file Form 990-EZ or 990, then it must file a complete return with the IRS by providing the required information, and schedules.

2. Instructions to complete Schedule O with Form 990

Use Schedule O to provide any narrative information required for the following parts in Form 990.

-

Part III, Statement of Program Service Accomplishments

-

If answered “Yes” on Form 990 Part III, Line 2

- Describe the significant program services undertaken by an organization that was not listed on the prior Form 990 or 990-EZ.

-

If answered “Yes” on Form 990 Part III, Line 3

- Explain if the organization made any significant changes before the end of the tax year and info on how it conducted its program services. In case if the organization ceased to conduct significant program services that were conducted in a prior year, report them too in the schedule.

-

If answered “Yes” on Form 990 Part III, Line 4d

- Explain about the Other Program Services conducted by the organization.

-

If answered “Yes” on Form 990 Part III, Line 2

-

Part V, Statements Regarding Other IRS Filings and Tax Compliance.

-

“No” response to line 3b.

- Explain why the organization didn't file 990-T even though it received a gross amount of $1,000 as unrelated business income for the tax year.

-

“Yes” or “No” response to line 13a.

- Report information (for both responses) on each state in which the organization is licensed to issue qualified health plans, the dollar amount of reserves each state requires the organization to maintain, and the dollar amount of reserves the organization maintains and reports to each state.

-

“No” response to line 14b.

- Explain why the organization didn't file Form 720 to report the payments it received for indoor tanning services for the tax year.

-

“No” response to line 3b.

-

Part VI, Governance, Management, and Disclosure

-

Material differences in voting rights among members of the governing body in line 1a.

- Explain in the schedule about the material differences in the voting rights among members of the governing body. Also, if the organization delegated its authority to an executive committee or similar committee with broad authority to act on behalf of the governing body, and if the committee held such authority at any time during the organization's tax year, it must be reported in Schedule O.

-

“Yes” responses to lines 2 through 7b.

- For every “Yes” response made in lines 2 through 7b of Part VI, describe the circumstances, processes, or changes made in the Schedule.

- “No” responses to lines 8a, 8b, and 10b.

-

“Yes” response to line 9.

- Provide the name and mailing address of the organization's officers, directors, trustees, or key employees in the schedule. This information provided by the organization will be made available to the public.

-

Material differences in voting rights among members of the governing body in line 1a.

-

Part VII, Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors.

- Explain in the schedule about the compensation paid by a related organization. This information provided is only considered valid for the time during which the related organization was related, and not for the entire calendar year ending with or within the tax year, and state the period during which the related organization was related.

- If the organization is unable to provide the required information in Column (E) of Part VII, Form 990, the organization can describe in the schedule on the efforts undertook by it to obtain information on compensation paid by related organizations.

-

Part IX, Statement of Functional Expenses

- line 11g (other fees for services), including the type and amount of each expense, included in line 11g, if the amount in Part IX, line 11g, exceeds 10% of the amount in Part IX, line 25 Column A (total expenses).

- Line 24e (all other expenses), including the type and amount of each expense, included in line 24e if the amount on line 24e exceeds 10% of the amount in Part IX, line 25 Column A (total expenses).

-

Part XI, Reconciliation of Net Assets.

- Explain the other changes in net assets or fund balances reported on line 9.

-

Part XII, Financial Statements, and Reporting.

- Change in accounting method or description of other accounting methods used

in line 1. B - Change in committee oversight review from the prior year on line 2c.

-

“No” response to line 3b.

- Explain in the schedule why the organization did not undergo the required audit or audits and also steps taken by it if attempted to undergo the audits.

- Change in accounting method or description of other accounting methods used

3. Instructions to complete Schedule O with Form 990-EZ

Use Schedule O to provide any narrative information required for the following parts in the

Form 990-EZ.

-

Form 990-EZ, Parts I, II, III, and V

-

Part I, Revenue, Expenses, and Changes in Net Assets or Fund Balances.

- Line 8 - Explain in the schedule about the various source of revenue generated by the organization for the tax year that was not mentioned in Part I lines 1 through 7 of Form 990-EZ.

- Line 10 - Provide a list with information on every grantee organization or individual to whom the organization paid the grant amount for the tax year that exceeds over $5,000.

- Line 16 - Report information on the other expenses made by the organization that wasn't reported on lines 10 through 15 Part I of Form 990-EZ.

- Line 20 - Describe in the schedule the changes made in the net assets or fund balances between the beginning and end of the organization's tax year that aren’t accounted for by the amount entered on line 18 Part I of 990-EZ.

-

Part I, Revenue, Expenses, and Changes in Net Assets or Fund Balances.

-

Form 990-EZ, Part II, Balance Sheets

- Describe the other assets that were reported in Line 24 Part II of the Form 990-EZ.

- Describe the total liabilities entered in Line 26 Part II. This includes accounts payable, grants payable, mortgages or other loans payable, and deferred revenue (revenue received but not yet earned).

-

Form 990-EZ, Part III, Statement of Program Service Accomplishments.

- Explain in the schedule, the other program services conducted by the organization, in response to line 31 Part III of IRS Form 990-EZ

-

Part V, Other Information.

-

“Yes” response to line 33.

- Explain in the schedule, a detailed description of each of the significant activity conducted by the organization that wasn't previously reported to the IRS.

-

“Yes” response to line 34.

- Describe in the schedule, the significant changes made in the organizing or governing documents. However, there's no need to attach a copy of the amendments or amended document to Form 990-EZ, unless those documents reflect a change in the organization's name.

-

“No” response to line 44d.

- Explain in the schedule why the organization didn't file Form 720 to report the payments it received for indoor tanning services for the tax year.

-

“Yes” response to line 33.

4. Choose ExpressTaxExempt to file your Form 990 with Schedule O

When you file IRS Form 990, the application will automatically generate Schedule O based on the information you provide on the form.

Our Software will validate the information you provide before transmitting to the IRS and allows you to correct the errors if any. This will avoid rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.