IRS Form 990 Schedule L Instructions

This article further explores the following points:

Form 990 / 990-EZ Schedule L - Overview

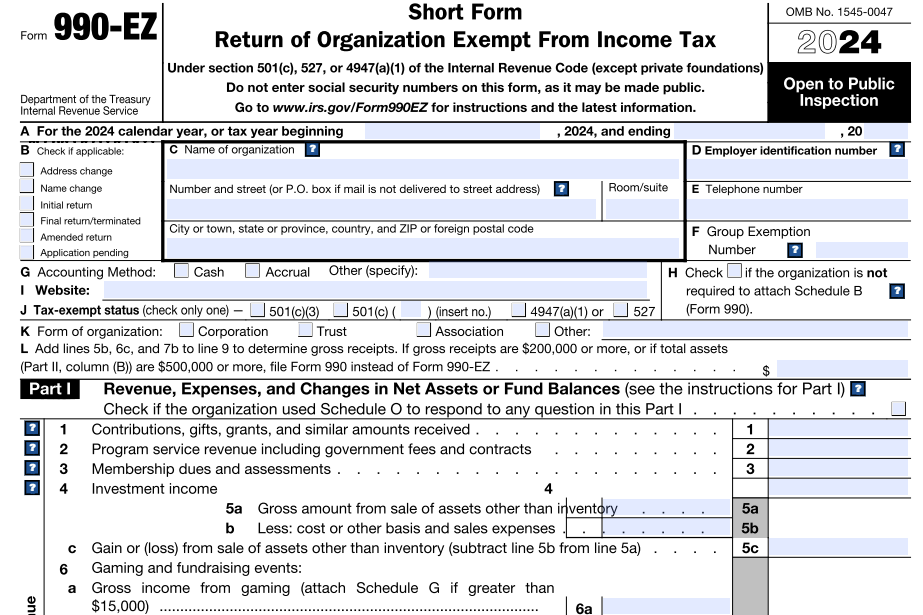

- Updated Decemebr 06, 2024 - 8.00 AM - Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations that file Form 990 or Form 990-EZ use schedule L to provide required information about financial transactions or arrangements between the organization and interested persons.

Table of Contents

1. What is the Purpose of Form 990 Schedule L?

3. Instructions to complete Schedule L with Form 990/990-EZ

Part I. Excess Benefit Transactions

Part II. Loans to and/or From Interested Persons

Part III. Grants or Assistance Benefiting Interested Persons

4. Choose ExpressTaxExempt to file your Form 990 with Schedule L

1. What is the Purpose of Form 990 Schedule L?

Schedule L (Form 990 or 990-EZ) is used by an organization that files Form 990 or 990-EZ to provide information on certain financial transactions or arrangements between the organization and disqualified person(s) under section 4958 or other interested persons.

Schedule L is also used to determine whether a member of the organization's governing body is an independent member for purposes of Form 990, Part VI, line 1b.

Who are interested persons?

For purposes of Part I, an interested person is a disqualified person under section 4958.

For purposes of Parts II–IV, an interested person is one of the following.

1. For Form 990 filers, a person required to be listed on Form 990, Part VII, Section A as a current or former officer, director, trustee, or key employee, and for Form 990-EZ filers, a current officer, director, trustee, or key employee required to be listed on Form 990-EZ, Part IV. For purposes of reporting management company transactions on Part IV, however, a former officer, director, trustee, or key employee of the organization within the last 5 tax years is treated as an interested person whether or not required to be so listed.

2. The creator or founder of the organization, including the sponsoring organizations of a Voluntary Employees' Beneficiary Association (VEBA).

3. A substantial contributor. For purposes of Schedule L, Parts II–IV, a substantial contributor is an individual or organization that made contributions during the tax year in the aggregate of at least $5,000, and whose contributions are required to be reported on Schedule B (Form 990, 990-EZ, or 990-PF), Schedule of Contributors, for the organization’s tax year. A substantial contributor may include an employer that contributes to a VEBA.

4. For purposes of Part III, a member of the organization’s grant selection committee.

5. A family member of any individual described above.

6. A 35% controlled entity of one or more individuals and/or organizations described above.

7. For purposes of Part III, an employee (or child of an employee) of a substantial contributor or of a 35% controlled entity of such person, but only if the employee (or child of an employee) received the grant or assistance by the direction or advice of the substantial contributor or designee or of the 35% controlled entity, or under a program funded by the substantial contributor that was intended primarily to benefit such employees (or their children).

2. Who Must File Schedule L?

The chart below provides which organizations must complete all or a part of Schedule L and must attach Schedule L to Form 990 or 990-EZ.

| Type of filer | IF you answer “Yes” to | THEN you must complete |

|---|---|---|

| Section 501(c)(3), 501(c)(4), or 501(c)(29) organization | Form 990, Part IV, line 25a or 25b(regarding excess benefit transactions) | Schedule L, Part I |

| Section 501(c)(3), 501(c)(4), or 501(c)(29) organization | Form 990-EZ, Part V, line 40b (regarding excess benefit transactions) | Schedule L, Part I |

| All organizations | Form 990, Part IV, line 26 (regarding loans) | Schedule L, Part II |

| All organizations | Form 990-EZ, Part V, line 38a (regarding loans) | Schedule L, Part II |

| All organizations | Form 990, Part IV, line 27 (regarding grants) | Schedule L, Part III |

| All organizations | Form 990, Part IV, line 28a, 28b, or 28c (regarding business transactions) | Schedule L, Part IV |

3. Instructions to complete Schedule L with Form 990/990-EZ

Part I. Excess Benefit Transactions

To be completed by section 501(c)(3), 501(c)(4), and 501(c)(29) organizations only. Complete if the organization answered “Yes” on Form 990, Part IV, line 25a or 25b, or Form 990-EZ, Part V, line 40b.

Excess benefit transaction. An excess benefit transaction is a transaction done by a tax-exempt organization which directly or indirectly provides to or for the use of a disqualified person an economic benefit, the value of which exceeds the value of the consideration received by the organization for providing such benefit.

If governing transactions with donor-advised funds and supporting organizations, check the special rules described under Section 4958 Excess Benefit Transactions in Appendix G in the Instructions for

Form 990, or Appendix E in the Instructions for Form 990-EZ. However, these applicable tax-exempt organizations are generally limited to organizations(without regard to any excess benefit) described under section 501(c)(3) public charities, section 501(c)(4) or 501(c)(29) organizations, or organizations that had such status at any time during the 5 year period, ending on the date of the excess benefit transaction.

Part II. Loans to and/or From Interested Persons

Complete if the organization answered “Yes” on Form 990-EZ, Part V, line 38a or Form 990, Part IV, line 26; or if the organization reported an amount on Form 990, Part X, line 5, 6, or 22.

In Part II, report details on loans, including salary advances, payments made under a split-dollar life insurance arrangement that are treated as loans under Regulations section 1.7872-15, and other advances and receivables (referred to collectively as “loans”), as described on Form 990, Part IV, line 26 (including receivables reported on Form 990, Part X, line 5, 6, or 22), on Form 990-EZ, Part V, line 38a, or on Form 990, Part IV, line 26 (if the organization reported an amount on Form 990, Part X, line 5, 6, or 22).

Only loans which are outstanding as of the end of the organization's tax year between the organization and interested persons must be reported in Schedule L. You must report these loans separately, regardless of the amount. Also report loans that were originally transacted between the organization and an interested person, between the organization and a third party that were transferred to become a debt outstanding between the organization and an interested person.

Part III. Grants or Assistance Benefiting Interested Persons

Complete if the organization answered “Yes” on Form 990, Part IV, line 27.

Under Part III, Grants or Assistance Benefiting Interested Persons, report each grant or other assistance (including provision of goods, services, or use of facilities), regardless of amount, provided by the organization to any interested person at any time during the organization's tax year. Scholarships, fellowships, discounts on goods or services, internships, prizes, and awards are some common examples for grants.

Part IV. Business Transactions Involving Interested Persons

Complete if the organization answered “Yes” on Form 990, Part IV, line 28a, 28b, or 28c.

In Part IV, report the business transactions for which payments were made during the organization's tax year between the organization and an interested person, if such payments exceeded the reporting thresholds described below, and regardless of when the transaction was entered into by the parties. The “ordinary course of business” exception to reporting business relationships on Form 990, Part VI, line 2, doesn't apply for purposes of Schedule L, but see the exception below for publicly traded companies.

In general, an organization must report business transactions on Part IV with an interested person if:

1. all payments during the tax year between the organization and the interested person exceeded $100,000;

2. all payments during the tax year from a single transaction between such parties exceeded the greater of $10,000 or 1% of the filing organization's total revenue for the tax year;

3. compensation payments during the tax year by the organization to a family member of a current or former officer, director, trustee, or key employee of the organization listed on Form 990, Part VII, Section A, exceeded $10,000; or

4. in the case of a joint venture with an interested person, the organization has invested $10,000 or more in the joint venture, whether or not during the tax year, and the profits or capital interest of the organization and of the interested person each exceeds 10% at some time during the tax year.

Business transactions. Business transactions include but aren't limited to joint ventures and contracts of sale, lease, license, insurance, and performance of services, whether initiated during the organization's tax year or ongoing from a prior year.

Part V. Supplemental Information

Part V, Supplemental Information is used by organizations to explain or provide additional information regarding a transaction. Under this part, identify the specific part and line number that each response supports, in the order in which those parts and lines appear on Schedule L (Form 990 or 990-EZ). The part can also be duplicated by the organization in need of additional space to report information.

4. Choose ExpressTaxExempt to file your Form 990 with Schedule L

When you file Form 990, the application will automatically generate Schedule L based on the information you provide on the form.

Moreover, the application will validate the information you provide against the IRS business rules and identify the errors before transmitting it to the IRS. This will do away with unnecessary rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.