Form 990-PF, 990-EZ and 990 Schedule B Instructions for 2024:

- Updated December 06, 2024 - 8.00 AM - Admin, ExpressTaxExempt

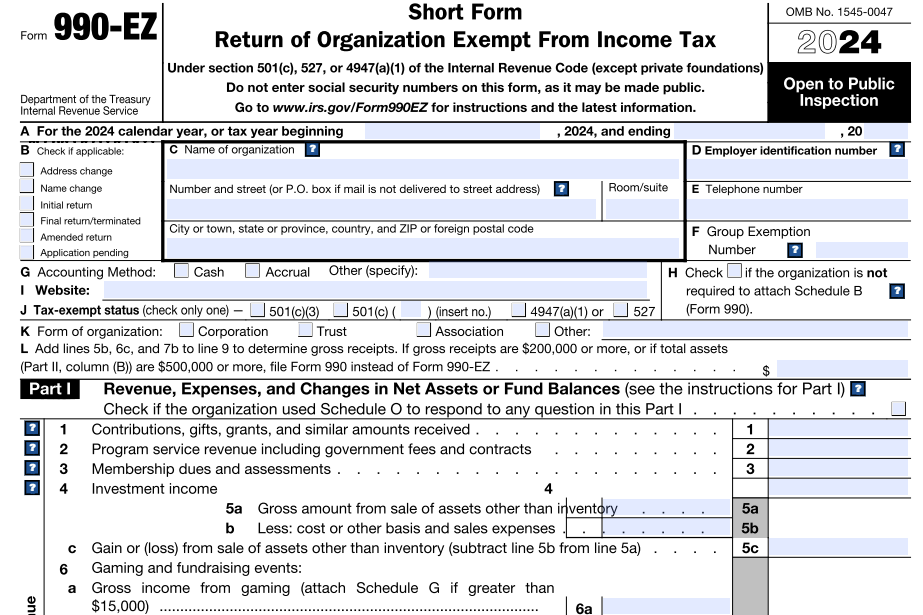

Nonprofits Organizations who file Form 990, 990-EZ, or 990-PF may be required to attach Form 990 Schedule B to report additional information about contributions in accordance with

IRS filing requirements.

Table of Contents

1. What is the Purpose of Form 990 Schedule-B?

Form 990 Schedule B is used by the Nonprofit Organizations to report information about the contributors who contributed the greater of $5,000 or more than 2% of revenues.

2. What is Form 990 Schedule B?

Form 990 Schedule B is an additional filing requirement used by nonprofit organizations to report information about the contributions they received during the corresponding tax year to the IRS.

This schedule provides detailed information about the organization’s significant contributors, and contributions made throughout the tax year.

3. Who must file Form 990 Schedule-B?

Form 990 Schedule B must be filed by tax-exempt organizations that are required to file Form 990, 990-EZ, or 990-PF.

Generally, a nonprofit organization must file Schedule B with Form 990 if it receives contributions of the greater of $5,000 or more from any one contributor.

The organizations that are required to complete 990 Schedule B must meet either the 'General Rule' or one of the 'Special Rules’.

General Rule

Organizations required to e-file Form 990-PF, 990-EZ, or 990 and that receive contributions of $5,000 or more from a single donor during the tax year must complete Part I and Part II of Schedule B.

Special Rules

-

501(c)(3) Organizations:

If these organizations meet the 33 ⅓% support test and are required to e-file Form 990 or 990-EZ, they must complete Part I and Part II of Schedule B for any donor who gives $5,000 or more, or 2% of total contributions, whichever is greater.

-

501(c)(7), (8), or (10) Organizations:

-

If they receive contributions of more than $1,000 specifically for religious, charitable, scientific, literary, educational purposes, or to prevent cruelty to children or animals, they must complete Part I and Part II of Schedule B.

-

If they receive less than $1,000 for these purposes, they only need to report the amount and complete Schedule B if the General Rule applies.

-

4. Form 990 Schedule B Instructions - A Step-By-Step Guide

Basic Information

Initially, you need to provide the following basic information about your organization:

- Name of the Organization

- Employer Identification Number (EIN)

- Organization Type

You must also indicate whether your organization is subject to the General or Special Rule.

Part I - Contributors

What are contributors and contributions?

Individuals, fiduciaries, partnerships, corporations, associations, trusts, and exempt organizations are considered Contributors. In addition, section 509(a)(2), 170(b)(1)(A)(iv), and 170(b)(1)(A)(vi) organizations must also report governmental units as contributors.

- Section 509(a)(2) Organizations - A 509(a)(2) organization is primarily supported by income earned from activities directly related to its tax-exempt purpose, often called mission-related income.

- Section 170(b)(1)(A)(iv) & 170(b)(1)(A)(vi) Organizations - These sections define public charities that receive significant support from the general public or government. To qualify, an organization must get at least one-third of its support from these sources, demonstrating broad-based public support.

Contributions are donations, grants, bequests, devices, and gifts of money or property, whether or not for charitable purposes. Any individual who contributes to a tax-exempt organization is considered a contributor.

Nonprofit Organizations must enter the following contributors' information, such as name, address, total contributions, and type of contribution (Person, Payroll, Noncash), to the IRS on part I of Schedule B.

- Name

- Address

- Total contributions

- Type of contribution (Person, payroll, Noncash)

Part II - Noncash Property

Noncash property is gained through contributions of anything but money. This includes real estate, equipment, vehicles, artwork, and non-physical assets like stocks or intellectual property. These contributions require an explanation, as well.

- Enter the description of noncash property received from the contributors during the tax year regardless of the value of that noncash contribution.

- Also, report the property with readily determinable market value (for instance, market quotations for securities) by listing its fair market value (FMV) and the date you

received it.

Part III - Exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7), (8), or (10) that total more than $1,000 for the year from a single contributor

A religious, charitable contribution means a contribution or gift to or for the use of a corporation, trust, or community chest, fund, or foundation organized and operated exclusively for religious and charitable purposes.

Organizations under Section 501(c)(7), (8), or (10) that received contributions for religious, charitable, etc., purposes during the tax year must complete Part III of Form 990 Schedule B for each person whose gifts totaled more than $1,000 during the tax year.

Section 501(c)(7)

Section 501(c)(7) pertains to social clubs. To be exempt, a social club must meet the following requirements:

- Must be organized for exempt purposes. Substantially, all of its activities must further exempt purposes.

- Must provide an opportunity for personal contact among members, and membership must be limited.

- Must be supported by membership fees, dues, and assessments.

- The organization's net earnings may not benefit any person with a personal and private interest in its activities.

- The club's governing instrument may not contain a provision that provides for discrimination against any person based on race, color, or religion.

- May not hold itself out as providing goods and services to the general public.

Section 501(c)(8)

This section defines what actions a fraternal beneficiary society must take to be tax-exempt. The actions include:

- Must have a fraternal purpose

- Must operate under the lodge system

- Must provide for the payment of life, sick, accident, or other benefits

Section 501(c)(10)

Organizations listed under section 501(c)(10) are considered Domestic Fraternal Societies. To remain tax-exempt, these organizations must:

- Be organized in the US

- Operate under the lodge system

- Devote its net earnings exclusively to religious, charitable, scientific, literary, educational, and fraternal purposes.

- Do not provide for the payment of life, sick, accident, or other benefits to its members.

In this part, you must provide the following information:

- Enter the total amount (that was $1,000 or less) received for the tax year (Exclusive for religious, charitable, etc.)

- Purpose of gift

- Use of gift

- Describe how the amount is held

- Show the name and address of the transferee organization and explain the relationship between the two organizations.

5. Choose ExpressTaxExempt to File your Form 990-PF/990-EZ/990 with

Free Schedule B

As an IRS-authorized software, we provide a safe, secure, and accurate filing experience.

- Start preparing your 990 Forms using our Form entry or interview-style filing process with free attachment of required schedules.

- Our software will validate your Form for errors and ensure the transmission of error-free returns. Then, you can transmit your form to the IRS securely.

- If you filed the prior year's returns with ExpressTaxExempt, you can copy information from them to the current return.