IRS Form 990 Schedule G Instructions

This article further explores the following points:

Form 990/990-EZ Schedule G - Supplemental Information Regarding Fundraising or Gaming Activities

- Updated December 06, 2024 - 3.00 PM - Admin, ExpressTaxExemptNonprofits and Tax-Exempt Organizations that file Form 990, 990-EZ use Schedule G to provide supplemental information about Fundraising or Gaming Activities.

Information provided on Form 990/990-EZ schedule G will become available for the public to access and it helps volunteers, funders, contributors to find and evaluate the best charity to support.

Table of Contents

1. What is the Purpose of Form 990/990-EZ Schedule G?

2. Who Must File Form 990/990-EZ Schedule G?

3. Instructions to complete Schedule G with Form 990/990-EZ

Part I of Form 990/990-EZ Schedule G - Fundraising Activities

Part II of Form 990/990-EZ Schedule G - Fundraising Events

Part III of Form 990/990-EZ Schedule G - Gaming

Part IV of Form 990/990-EZ Schedule G - Supplemental Information

1. What is the Purpose of Form 990/990-EZ Schedule G?

Schedule G is generally used by Nonprofits and tax-exempt organizations to provide required information about the professional fundraising services, fundraising events, and gaming.

2. Who Must File Form 990/990-EZ Schedule G?

Nonprofits and tax-exempt organizations filing Form 990 and marking "Yes" to lines 17, 18, or 19 in Part IV, the Checklist of Required Schedules, must file Schedule G.

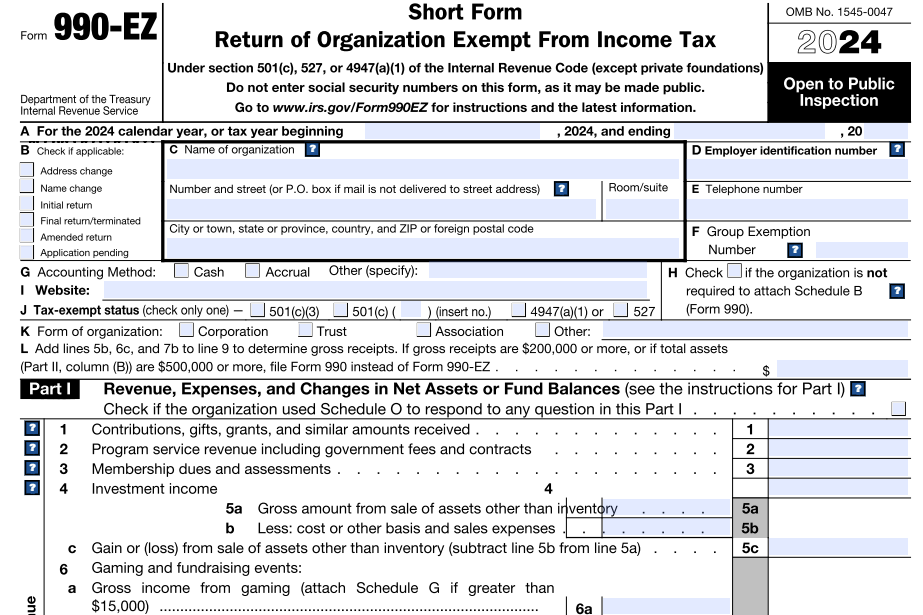

Also, Form 990-EZ filers meeting the criteria below must file Schedule G:

- Have reported more than $15,000 of fundraising event contributions and gross income on lines 1 and 6b in Part I.

- Have reported more than $15,000 of gross income from gaming on line 6a in Part I.

3. Instructions to complete Schedule G with Form 990/990-EZ

Part I of Form 990/990-EZ Schedule G - Fundraising Activities

Nonprofits and tax-exempt organizations filing Form 990 and reporting total expenses of more than $15,000 for professional fundraising services on lines 6 and 11e in Part IX must file Schedule G along with the form.

Nonprofit organizations filing Form 990-EZ aren’t required to complete Part I.

Check the box on the right against each fundraising method used by the Nonprofits and tax-exempt organizations to raise funds during the tax year.

Add fundraiser or individual details like name, address, activity, gross receipts, the amount paid to the fundraiser if the organization had a written or oral agreement with another person or entity in connection with professional fundraising services.

Enter the states in which the organization is registered or licensed to solicit contributions. Or, if they have been notified that they are exempt from such registration or licensing.

Part II of Form 990/990-EZ Schedule G - Fundraising Events

Form 990 filers reporting total amounts exceeding $15,000 on lines 1c and 8a in Part VIII, must complete Part II.

Form 990-EZ filers reporting total amounts exceeding $15,000 on lines 6a and 6b parenthetical in Part VIII, must complete Part II. Add only the fundraising events with gross receipts greater than $5,000 the organization conducted any time during the tax year.

There are two sections in part II - Revenue and Direct Expenses of the Fundraising Events.

Enter the top two fundraising events conducted by the organization with gross receipts greater than $5,000.

Revenue Details:

Enter the gross receipts, the total amount of contributions, gifts, and similar amounts received by the organization for fundraising events. Finally, enter the gross income from events listed without reduction for catering, entertainment, cost of goods sold, compensation, fees, or other expenses.

Direct Expenses Details:

Enter the total amount paid out as cash and noncash prizes, the amount spent on rent, entertainment, food and beverages, and other direct expenses. Finally, enter the net income from the fundraising events.

Part III of Form 990/990-EZ Schedule G - Gaming

Form 990 filers reporting more than $15,000 from gaming on line 9a in Part VIII, must complete Part III.

Form 990-EZ filers reporting more than $15,000 from gaming on line 6a in Part I, must complete Part III.

Enter the revenue and expenses of the games conducted, such as bingo, Pull tabs/instant bingo/progressive bingo.

The list of direct expenses should include the following:

- Labor costs and wages, including the total amount paid to gaming workers or independent contractors as labor costs.

- Employer's share of federal, state, and local payroll taxes paid for the tax year for gaming workers, including social security and Medicare taxes, state and federal unemployment taxes, and other state and local payroll taxes.

- Excise taxes, including any wagering tax paid with Form 730, Monthly Tax Return for Wagers, and any occupational tax paid with Form 11-C, Occupational Tax and Registration Return for Wagering.

Finally, enter the net income from the gaming activity.

Also, the Organization should provide the state details in which the organization conducts gaming activities, Gaming manager information, and more.

Check with the instruction in detail to complete Form 990 Schedule G.

Part IV of Form 990/990-EZ Schedule G - Supplemental Information

The organization must use Part IV to provide the required explanations, if applicable, to supplement responses to

- Part I, line 2b, columns (iii) and (v), and

- Part III, lines 9, 9b, 10b, 15b, 15c, 16, and 17b.

4. Other Resources in 990/990-EZ Schedule G

What are fundraising events?

Fundraising events are activities meant to get potential donors to contribute money, securities, services, materials, facilities, other assets, or time. They include:

- Publicizing and conducting fundraising campaigns.

- Maintaining donor mailing lists.

- Conducting fundraising events.

- Preparing and distributing fundraising manuals, instructions, and other materials.

- Professional fund-raising services.

- Conducting other activities involved with soliciting contributions from individuals, foundations, governments, and others.

- Fund-raising activities do not include gaming, the conduct of any trade or business that is regularly carried out, or activities substantially related to the accomplishment of the organization's exempt purpose (other than by raising funds).

What are gaming activities?

The term gaming includes bingo, beano, raffles, lotteries, pull-tabs, scratch-offs, pari-mutuel betting, Calcutta wagering, pickle jars, punchboards, tip boards, tip jars, certain video games, and other games of chance. Most forms of gaming, if regularly carried on, result in unrelated business income (UBI), and the income may be taxable.

Choose ExpressTaxExempt to file your Form 990/990-EZ with Schedule G

When you start filing the Form 990/990-EZ, the Schedule G will generate automatically based on the information you provided on the Form.

Our Software will review your Form for any errors, and ensure the transmission of error-free returns. We then transmit your Form to the IRS securely.

As we are an IRS Authorized software, we provide a safe, secure, and accurate filing experience.