IRS Form 990 Schedule R Instructions

This article further explores the following points:

Form 990 Schedule R - Related Organizations and Unrelated Partnerships

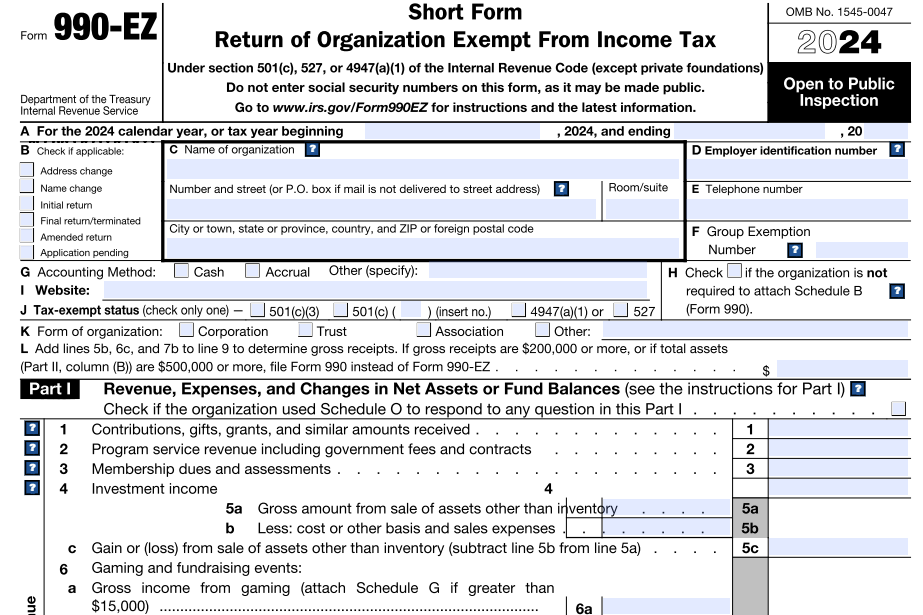

- Updated December 06, 2024 - 8.00 AM - Admin, ExpressTaxExemptSchedule R is filed by an organization along with Form 990 to report information on related organizations and certain transactions made with them. The schedule is also used to provide info on certain unrelated partnerships through which the organization conducted significant activities during the tax year.

Table of Contents

1. Who must file Form 990 Schedule R?

2. Instructions to complete Part I of Form 990 Schedule R - Identification of Disregarded Entities

6. Instructions to complete Part V of Form 990 Schedule R- Transactions With Related Organizations

9. Choose ExpressTaxExempt to file your Form 990 with Schedule R

10. Article Sources

1. Who must file Form 990 Schedule R?

The organization which answered "Yes" to the lines of Form 990 mentioned below must file and attach Schedule R.

The organizations that attach the schedule may choose to complete either all the Parts or the required Parts of the schedule which depends on the answer provided by them in Part IV, Checklist of Required Schedules of Form 990.

- If answered "Yes" to line 33 of Part IV (regarding disregarded entities), the organization must complete Part I of Schedule R.

- If answered "Yes" to line 34 of Part IV (regarding related organizations), the organization must complete Schedule R, Parts II, III, IV, and V, line 1, as applicable.

- If answered "Yes" to line 35b of Part IV (regarding payments from or transactions with controlled entities), the organization must complete line 2 of Part V in Schedule R.

- If answered "Yes" to line 36 of Part IV (regarding transfers to exempt non charitable related organizations), the organization must complete line 2 of Part V in Schedule R. (Only for Section 501(c)(3) Organizations).

- If answered "Yes" to line 37 of Part IV (regarding the conduct of activity through an unrelated partnership), the organization must complete Part VI of the Schedule.

2. Instructions to complete Part I of Form 990 Schedule R - Identification of Disregarded Entities

Part I of Form 990 Schedule R requires identifying information on any organizations that are treated for federal tax purposes as disregarded entities of the filing organization.

Enter the details of each disregarded entity on separate lines of Part I.

- Name, address, and EIN of the disregarded entity

- Primary activity

- The U.S. state (or U.S. possession) or foreign country in which the disregarded entity is organized.

- Amount of the filing organization's total revenue reported in line 12, Column (A), Part VIII, Form 990 attributable to the disregarded entity

- Amount of the organization's total assets reported in line 16, column (B), Part X, Form 990 attributable to the disregarded entity

- Name of the entity that directly controls the disregarded entity

3. Instructions to complete Part II of Form 990 Schedule R - Identification of Related Tax-Exempt Organizations

In Part II of the schedule, the organization is required to treat governmental units and instrumentalities and foreign governments as tax-exempt organizations.

Enter the details of each related organization on separate lines of Part II.

- Name, address, and EIN

- The primary activity of the related Organization

- The US State or foreign Corporation in which the related Organization is organized

- Exempt Code section that describes related Organization

- Public charity status

- Name of the entity that directly controls the related organization

- Check “Yes” if the related organization is a controlled entity of the filing organization under section 512(b)(13)

4. Instructions to complete Part III of Form 990 Schedule R - Identification of Related Organizations Taxable as a Partnership

Use Part III of the schedule to identify any related organization that is treated as a partnership for federal tax purposes.

If the partnership is related to the filing organization by being its parent or brother/sister organization and filing organization isn't a partner or member in the partnership, then the organization must complete only columns (a), (b), and (c), and enter “N/A” in columns (d), (e), (f), (g), (i), and (k).

Enter the details of each related organization on separate lines of Part III

- Name, address, and EIN

- The Primary activity of the related Organization

- The US State or foreign Corporation in which the related Partnership is organized

- Name of the entity that directly controls the related partnership

- Predominant income that is more accepted from the following income (Related, unrelated, and income excluded from tax under sections 512—514)

- Share of total income

- Share of the related partnership's end-of-year assets

- Column (h), disproportionate allocations required to state the response of the filing organization's interest. The organization must check “Yes” if its interest as a partner in any item of income, gain, loss, deduction, or credit, or any right to distributions was disproportionate to its investment at any time during the tax year. If otherwise, check “No”.

- The dollar amount that is listed as Code V amount (unrelated business taxable income) in box 20 of Schedule K-1 (Form 1065) received from the related partnership for the partnership's tax year that ends with or within the filing organization's tax year. If no Code V amount is listed in box 20, enter as “N/A”.

- Column (j), General, or managing partner requires information on the organization's partnership. The organization must check “Yes” if at any time during the tax year, it possessed a role of a general partner of a related limited partnership, or a managing partner or managing member of a related general partnership, LLC, or another entity taxable as a partnership. If otherwise, check “No”.

- Percentage ownership of the filing organization.

Note - In case if the organization needs to report more related organizations that require additional space, the part can be duplicated based on the requirement.

5. Instructions to complete Part IV of Form 990 Schedule R - Identification of Related Organizations Taxable as a Corporation or Trust.

Use this part to identify any related organization treated as a C or S corporation or trust for federal tax purposes (such as a charitable remainder trust), other than a related organization reported as a tax-exempt organization in Part II of Schedule.

Enter the following details of the related organization in each line of the Part:

- Name, Address, EIN of related organization

- The Primary activity of the related organization

- The US State or foreign Corporation in which the related Organization is organized

- Name of the entity that directly controls the related organization

- Type of entity (C or S Corporation)

- Share of total income

- Share of the related organization's end-of-year total assets.

- Percentage ownership

- Check “Yes” if the related organization is a controlled entity of the filing organization under section 512(b)(13). If otherwise, check “No”.

Note - In case if the organization needs to report more related organizations that require additional space, the part can be duplicated based on the requirement.

6. Instructions to complete Part V of Form 990 Schedule R - Transactions With Related Organizations

Part V must be completed by an organization that answered “Yes” on line 34, 35b, or 36, Part IV,

Form 990.

This part consists of a set of questions that requires “Yes” or “No” response from the filing organization.

- Gift, grant, or capital contributed to and received from the related organization(s)

- Loans or loan guarantees to or for the related organization(s)

- Loans or loan guarantees by the related organization(s)

- Dividends from the related organization(s)

- Sale of assets to the related organization(s)

- Purchase of assets from and exchange of assets with the related organization(s)

- Lease of facilities, equipment, or other assets contributed to and received from the related organization(s)

- Performance of services or membership or fundraising solicitations for and by the related organization(s)

- Sharing of facilities, equipment, mailing lists, or other assets with the related organization(s)

- Sharing of paid employees with the related organization(s)

- Reimbursement paid to and by the related organization(s) for expenses

- Other transfer of cash or property to and from the related organization(s)

7. Instructions to complete Part VI of Form 990 Schedule R - Unrelated Organizations Taxable as a Partnership

Part VI of the schedule is used by the filing organization to provide information on any unrelated organization that meets all the following conditions:

1. The organization that is treated as a partnership for federal tax purposes (S corporations are excluded).

2. The organization that was a partner or member of the filing organization during the filing organization's tax year.

3. The organization with which the filing organization conducted more than 5% of its activities, based on the greater of its total assets or total revenue at the end of the filing organization's tax year.

8. Instructions to complete Part VII of Form 990 Schedule R - Supplemental Information

Part VII, Supplemental Information is used by the organization to provide additional information in response to the question in the Schedule. While filing this part, identify the specific part and line number that each response supports in the order in which those parts and lines appear on Schedule.

The Part can also be duplicated by the Form 990 filers in need of additional space to provide additional information.

9. Choose ExpressTaxExempt to file your Form 990 with Schedule R

When you file Form 990, the application will automatically generate Schedule R based on the information you provide on the form.

Our Software will validate the information you provide before transmitting to the IRS and allows you to correct the errors if any. This will avoid rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.

10. Article Sources