IRS Form 990 Schedule N Instructions

This article further explores the following points:

Form 990 Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

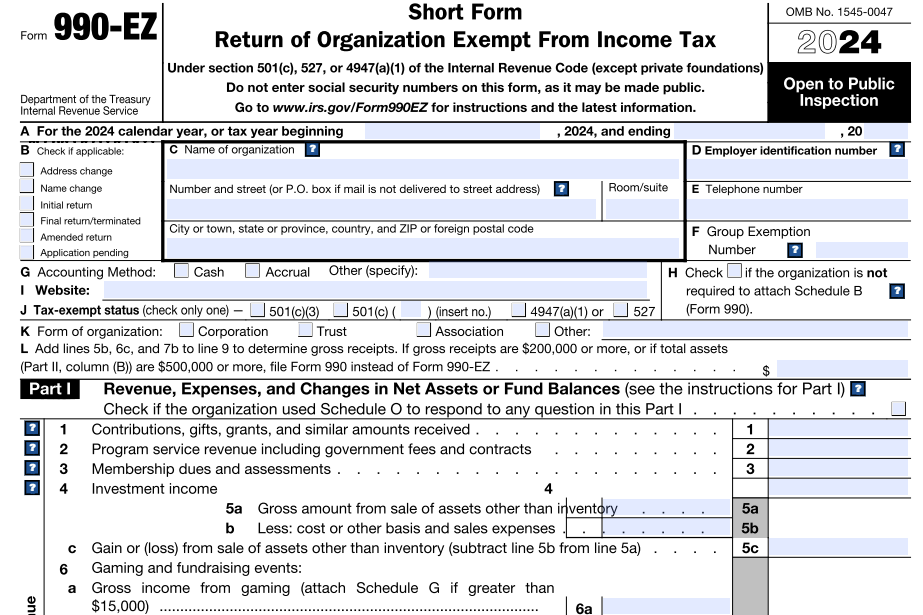

- Updated Dcember 06, 2024 - 8.00 AM - Admin, ExpressTaxExemptSchedule N is used by the 990 or 990-EZ filers to report information on their organization that is either going out of existence or disposing of more than 25% of its net assets through sale, exchange, or other disposition.

Table of Contents

1. Who must file Form 990 Schedule N?

Any organization that files Form 990/990-EZ and answers “Yes” to the following lines, must complete and attach Schedule N along with its information return.

- Form 990, Part IV, Checklist of Required Schedules, line 31 or 32

- Form 990-EZ, Part V, Other Information, line 36.

However, an organization that files Schedule N even though it's not required, must complete all the parts of the schedule and provide all the information requested.

2. Instructions to complete Part I of Form 990 Schedule N - Liquidation, Termination, or Dissolution

-

If the organization answered “Yes” to line 31, Part IV of Form 990, it must complete Part I.

- This line questions whether the organization has undergone liquidation, termination, or dissolution and cease operations.

-

If the organization answered “Yes” to line 36, Part V of Form 990, because it fully liquidated, dissolved, or terminated during the tax year, then it must complete Part I.

- This line questions whether the organization has undergone a liquidation, dissolution, termination, or significant disposition of net assets during the tax year.

In need of additional space for reporting information, Part I of the schedule can be duplicated based on the requirement.

Enter the details of the assets distributed or transaction expenses paid

- Date of distribution

- The fair market value of the asset(s) distributed or amount of transaction expenses

- Method of determining FMV for asset distributed or transaction expenses

- EIN of recipient

- Name and address of the recipient

- IRC section of recipient or type of entity

3. Instructions to complete Part II of Form 990 Schedule N - Sale, Exchange, Disposition, or Other Transfer of More Than 25% of the Organization’s Assets

-

If the organization answered “Yes” to line 32, Part IV of Form 990, it must complete Part II of the schedule

- This lines questions whether the organization sell, exchange, dispose of, or transfer more than 25% of its net assets.

-

If the organization answered “Yes” to line 36, Part V of Form 990, because it fully liquidated, dissolved, or terminated during the tax year, then it must complete Part II

- This line questions whether the organization has undergone a liquidation, dissolution, termination, or significant disposition of net assets during the tax year.

In need of additional space for reporting information, the part can be duplicated based on the requirement.

4. Instructions to complete Part III of Form 990 Schedule N - Supplemental Information

Part III of the schedule can be used by the organization to provide the required explanation on lines 2e, 3, and 6c of Part I, Liquidation, Termination, or Dissolution and line 2e of Part II, Sale, Exchange, Disposition, or Other Transfer of More Than 25% of the Organization’s Assets.

The part can also be duplicated by the 990 and 990-EZ filers if more space is needed to provide additional information.

5. Choose ExpressTaxExempt to file your Form 990 with Schedule N

When you file Form 990 and Form 990-EZ, the application will automatically generate Schedule N based on the information you provide on the form.

Our Software will validate the information you provide before transmitting to the IRS and allows you to correct the errors if any. This will avoid rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.