IRS Form 990 Schedule F Instructions

This article further explores the following points:

Form 990 Schedule F - Statement of Activities Outside the United States

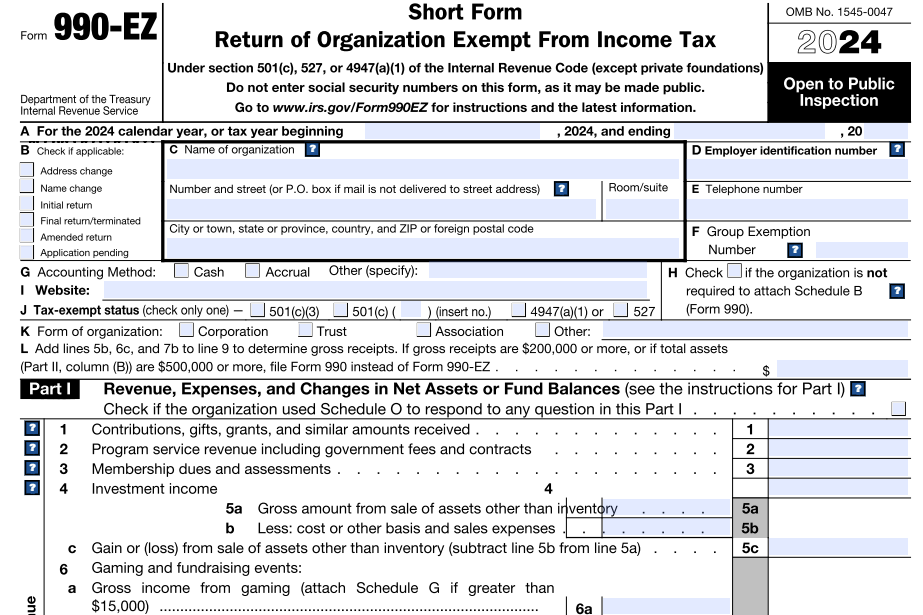

- Updated December 06, 2024 - 6.00 PM - Admin, ExpressTaxExemptSchedule F is filed by an organization along with its

990 return, to provide information on the activities conducted by the organization outside the United States at any time during the tax year.

These activities generally include grants and other assistance, program-related investments, fundraising activities, unrelated trade or business, program services, and investments. It also includes the maintenance of offices, employees, or agents to conduct any such activities in regions outside the United States.

Table of Contents

1. Who Must File Form 990 Schedule F?

2. What Accounting Method to use for calculating Schedule F?

3. Instructions to complete Schedule F with Form 990

Part I. Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts

Part II. Grants and Other Assistance to Organizations or Entities Outside the United States

Part III. Grants and Other Assistance to Individuals Outside the United States

4. Choose ExpressTaxExempt to file your Form 990 with Schedule F

1. Who Must File Form 990 Schedule F?

An organization that answered “Yes” on line 14b, 15, or 16, Part IV, Checklist of Required Schedules. Form 990 must complete the appropriate parts of the Schedule F and attach it along with its information return (Form 990).

2. What Accounting Method to use for calculating Schedule F?

Generally, an organization can use its normal accounting method to complete Part IX, Statement of Functional Expenses of Form 990. In case if the organization's accounting system doesn't allocate expenses, the organization can use any reasonable method of allocation to reporting the expenses.

However, if the organization checks “Accrual” on line 1, Part XII of Form 990, then the organization is considered to follow Financial Accounting Standards Board Accounting Standards Codification (FASB ASC 958) (formerly SFAS 116) and made a grant during the tax year that needs to be paid in the future to an individual outside the United States. The organization is also required to report the grant's present value in Part III, column (d) or (f) of the schedule, and report any accruals of present value increments in future years.

3. Instructions to complete Schedule F with Form 990

Part I. General Information on Activities Outside the United States

An organization that answered “Yes” on line 14b, Part IV of Form 990 must complete Part I of the schedule. This response states that the organization had aggregate revenues or expenses of more than $10,000 from or attributable to grantmaking, fundraising, business, investment, and program services outside the United States, or held investments outside the United States in foreign partnerships, foreign corporations, and other foreign entities with an aggregate book value of $100,000 or more at any time during the tax year

However, there's no need to report info on the expenses incurred for the services (for example, telemedicine and services provided over the Internet) within the U.S. that include recipients both inside and outside the United States.

Part II. Grants and Other Assistance to Organizations or Entities Outside the United States

An organization is required to complete this part if it answered “Yes” on line 15, Part IV of Form 990. This response indicates that the organization report an amount of more than $5,000 in line 3, Column (A) of Part IX, Statement of Functional Expenses in Form 990. The amount reported is considered as grants and other assistance made by any particular foreign organization or entity (including a foreign government) or to a domestic organization or domestic individual to provide grants or other assistance to a designated foreign organization or organizations.

Part III. Grants and Other Assistance to Individuals Outside the United States

Complete Part III of the schedule if the organization answered “Yes” on line 16, Part IV of Form 990. This response indicates that the organization report an amount of more than $5,000 in line 3, Column (A) of Part IX, Statement of Functional Expenses in Form 990. The amount reported is considered as grants and other assistance to foreign individuals and domestic organizations or domestic individuals to provide grants or other assistance to a designated foreign individual or individuals.

Part IV. Foreign Forms

Every organization that files Schedule F along with Form 990 must complete lines 1 to 6 of Part IV, Foreign Forms.

If the organization answered “Yes” to any of the lines from 1-6 due to engaging in the activities for the tax year described against each line, then the organization may need to file the form stated on that line. To determine whether an organization is required to file any of the IRS forms stated on lines 1–6 (Form 926, 3520, 3520-A, 5471, 5713, 8621, or 8865) of the schedule, the organization can refer the instructions of those forms.

However, there's no need to attach Form 3520, 3520-A, or 5713 along with Form 990.

Part V. Supplemental Information

Part V is used to provide narrative information required in the following supplement responses:

Line 2 of Part I(For grantmakers) - Explain the organization’s procedures for monitoring the use of its grants and other assistance outside the United States.

Line 3, column (f) of Part I- Description on the method used to account for expenditures on the organization's financial statements.

Line 1 of Part II - Description on the method used to account for cash grants and noncash assistance on the organization's financial statements

Part III Column - Description on the method used to account for cash grants and noncash assistance on the organization's financial statements

Part III, column (c) (Number of recipients) - Explain information on the estimated number of recipients that received the type of assistance in the region (column b).

In case of any narrative explanations and descriptions that need to be reported, the organization can use the Part to provide that information. Also, the part can be duplicated by the filing organization in need of additional space.

4. Choose ExpressTaxExempt to file your Form 990 with Schedule F

When you file Form 990, the application will automatically generate Schedule F based on the information you provide on the form.

Our Software will validate the information you provide before transmitting to the IRS and allows you to correct the errors if any. This will avoid rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.