IRS Form 990 Schedule D Instructions

This article further explores the following points:

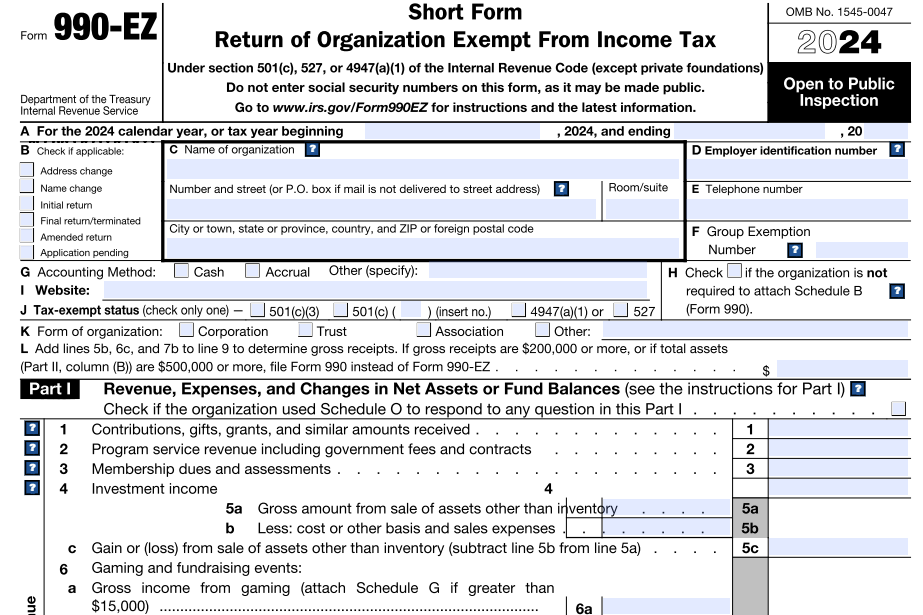

Form 990 / 990-EZ

Schedule D - Overview

- Updated December 06, 2024 - 8.00 AM

- Admin, ExpressTaxExempt

Nonprofits and Tax-Exempt Organizations that file Form 990 use schedule D to provide required information about Supplemental Financial Statements.

Table of Contents

1. What is the Purpose of Form 990 Schedule D?

3. Instructions to complete Schedule D with Form 990

Part I. Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts

Part II. Conservation Easements

Part IV. Escrow and Custodial Arrangements

Part VI. Land, Buildings, and Equipment

Part VII. Investments—Other Securities

4. Choose ExpressTaxExempt to file your Form 990/990-EZ with Schedule D

1. What is the Purpose of Form 990 Schedule D?

Schedule D (Form 990) is used by organizations which file IRS Form 990 to report information on donor-advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information.

2. Who Must File Schedule D?

An organization that answered “Yes” to any of lines 6 through 12a on Form 990, Part IV, Checklist of Required Schedules, must complete the appropriate part(s) of Schedule D (Form 990) and attach the schedule to IRS Form 990. An organization that answered “Yes” on Form 990, Part IV, line 12b, can complete Parts XI and XII of Schedule D (Form 990), but isn't required to do so.

3. Instructions to complete Schedule D with Form 990

Part I. Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts

Complete Part I if the organization answered “Yes” on Form 990, Part IV, line 6.

A Donor advised fund is more like a charitable investment account which is maintained and operated by section 501(c)(3) organizations.

Generally a donor advised fund must be

1. Separately identified by reference to contributions of a donor or donors

2. owned and controlled by a sponsoring organization and

3. For which the donor or donor advisor has or reasonably expects to have advisory privileges in the distribution or investment of amounts held in the donor advised fund or account because of the donor's status as a donor.

Part II. Conservation Easements

Complete Part II if the organization answered “Yes” on IRS Form 990, Part IV, line 7.

What is Conservation Easement?

A conservation easement can be defined as a legal agreement or a power invested in a qualified private land conservation organization or government (municipal, county, state or federal) to restrict, as to a specified land area, to achieve certain conservation purposes and protect its conservation values.

Part III. Organizations Maintaining Collections of Art, Historical Treasures, or

Other Similar Assets

Complete Part III if the organization answered “Yes” on Form 990, Part IV, line 8.

Part IV. Escrow and Custodial Arrangements

Complete Part IV if the organization answered “Yes” on Form 990, Part IV, line 9, or reported an amount on Form 990, Part X, line 21.

Part V. Endowment Funds

Complete Part V if the organization answered “Yes” on Form 990, Part IV, Line 10.

For Part V, Endowment Funds the definitions of endowment and types of endowments are governed by FASB ASC 958.

However, the information reported in Part V should pertain to the following:

1. An aggregate of the donor-restricted assets held by the organization

2. Organizations formed and maintained exclusively to further one or more exempt purposes of the organization, and

3. Organizations that hold endowment funds for the benefit of the organization.

What is an endowment fund?

An endowment is a donation of property or money to a non-profits, which uses the resulting investment income for a specific purpose.

Part VI. Land, Buildings, and Equipment

Complete Part VI if the organization answered “Yes” on Form 990, Part IV, line 11a, and reported an amount on Form 990, Part X, line 10a. Reporting is required if any amount other than zero is reported on those lines.

Part VII. Investments—Other Securities

Complete Part VII, Investments—Other Securities if the organization answered “Yes” on Form 990, Part IV, line 11b, or reported an amount in Form 990, Part X, column (B), line 12, that is 5% or more of the total assets reported on Form 990, Part X, column (B), line 16.

Closely held stock that must be reported in this part includes

1. Publicly-traded stock for which the organization holds 5% or more of the outstanding shares of the same class, and

2. Publicly-traded stock in a corporation that comprised more than 5% of the organization's total assets at the end of the tax year

Every publicly-traded stock held by the organization that meets either of these 5% ownership tests must be listed individually in the part.

Part VIII. Investments—Program Related

Complete Part VIII if the organization answered “Yes” on Form 990, Part IV, line 11c, and reported an amount on Form 990, Part X, column (B), line 13, that is 5% or more of the total assets reported on Form 990, Part X, column (B), line 16.

Program-related investments are investments made by an organization whose primary purpose focuses on the accomplishment of the organization's exempt status rather than to benefit income. Student loans and notes receivable from other exempt organizations are some common examples of program-related investments.

Part IX. Other Assets

Complete Part IX, Other Assets if the organization answered “Yes” on Form 990, Part IV, line 11d, or reported an amount on IRS Form 990, Part X, column (B), line 15, that is 5% or more of the total assets reported on Form 990, Part X, column (B), line 16.

Under this part, enter the description and the book value of each asset.

Part X. Other Liabilities

Complete Part X, Other Liabilities if the organization answered “Yes” on IRS Form 990, Part IV, line 11e or line 11f, and either reported an amount on Form 990, Part X, column (B), line 25 or had financial statements for the tax year that include a footnote addressing the organization's liability for uncertain tax positions.

Organizations are required to separately report all liabilities for federal income taxes and amounts owed to related organizations along with their book value on this part.

Parts XI Through XII. Reconciliation of Revenue and Expenses From Form 990 to Audited Financial Statements

Complete Parts XI and XII if the organization answered “Yes” on Form 990, Part IV, line 12a. If the organization answered “Yes” on IRS Form 990, Part IV, line 12b (but answered “No” on line 12a), completing Parts XI and XII is optional.

If the organization did not receive audited financial statementsstatements for the reporting year for which it is completing this Form 990, it isn't required to complete Parts XI or XII, even if it prepared IRS Form 990 in accordance with Financial Accounting Standards Board Accounting Standards Codification 958 (FASB ASC 958)

Part XIII. Supplemental Information

Part XIII must be completed to provide the information required in the following

- Part II, lines 3, 5, and 9 (conservation easements).

- Part III, lines 1a and 4 (collections of works of art, historical treasures, and other similar assets).

- Part IV, lines 1b and 2b (escrow or custodial arrangements, or credit counseling, debt management, credit repair, or debt negotiation services).

- Part V, line 4 (endowment funds).

- Part X, line 2 (note or footnote to financial statements regarding liability for uncertain tax positions).

- Part XI, lines 2d and 4b (reconciliation of revenue).

- Part XII, lines 2d and 4b (reconciliation of expenses).

Also, the organization can provide additional narrative explanations and descriptions in this part. This part can also be duplicated if the organization requires additional space to report information.

4. Choose ExpressTaxExempt to file your Form 990/990-EZ with Schedule D

When you file file Form 990-EZ/IRS Form 990, the application will automatically generate Schedule D based on the information you provide on the form.

Our Software will validate the information you provide before transmitting to the IRS and allows you to correct the errors if any. This will do away with unnecessary rejections.

ExpressTaxExempt is an IRS authorized e-file service provider with a track record of providing safe and secure e-filing experience to users.