IRS Form 990 EZ Instructions for 2024: Simplified Guide for Nonprofit Tax Filing

Quick Links:

The IRS Mandates

E-File of Form 990-EZ

Get Started with ExpressTaxExempt to

E-File Your Form 990-EZ!

- Secure & Accurate Filing

- Auto-generate required Schedules

- E-file your Amended Return

- Retransmit Rejected Return for Free

- Supports Extension Form 8868

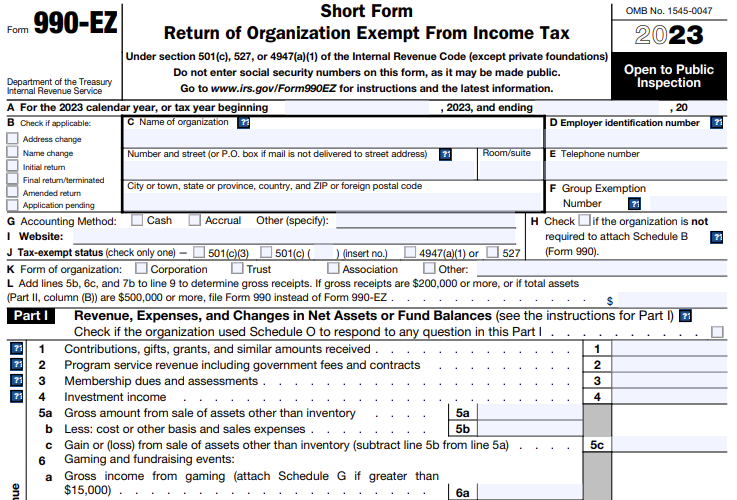

A Complete Line-By-Line Guide for IRS Form 990-EZ Instructions

- Updated August 27, 2024 - 8.00 AM - Admin, ExpressTaxExemptForm 990-EZ (Short Form Return of Organization Exempt From Income Tax) is filed by the organizations under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) whose gross receipts are less than $200,000 and total assets less than $500,000 to report their annual information to the IRS.

The deadline to file Form 990-EZ is the 15th day of the 5th month after their accounting period ends. If your organization follows a calendar year, the 990-EZ deadline is May 15th-to report their annual information to the IRS

If your organization follows a fiscal year, use our deadline finder to know your Form 990-EZ due date. If you need more time to file your 990-EZ return, you can apply for an extension using Form 8868.

With ExpressTaxExempt, you can e-file your 8868 extension in minutes.

E-file 8868 Now

This article shows you how to fill out your Form 990-EZ with step-by-step instructions.

Table of Contents

1. Instructions on How to Complete Form 990-EZ

IRS Form 990-EZ has six parts. Here are instructions for filling out each part

of the form.

Basic Information about your organization

The IRS requires you to provide the following information about your organization.

- A - Start and end dates of the corresponding tax year

-

B - Purpose of the form (check if applicable)

- Address change

- Name change

- Initial return

- Final return/terminated

- Amended return

- Application pending

- C - Name and address of the organization

- D - Employer Identification Number (EIN)

- E - Telephone number

- F - Group Exemption Number

-

G - Accounting method

- Cash

- Accrual

-

H - Check if the organization isn’t required to attach

Form 990 Schedule B - I - Website

-

J - Tax-exempt status (check the applicable section)

- 501(c)(3)

- 501(c)() - mention the number

- 4947(a)(1)

- 527

-

K - Form of organization

- Corporation

- Trust

- Association

- Other

- L - Gross receipts

Schedule O

Some of the questions in Parts I - VI may require you to attach

Form 990 Schedule O.

If you have used Schedule O to explain any of the questions in that part, check the box at the top of each part.

Part I - Revenue, Expenses, and Changes in Net Assets or Fund Balances

This part is split into three subparts.

- Revenue

- Expenses

- Net Assets

Revenue (Lines 1-9):

Here, you must report your organization’s revenue yielded from various sources.

-

Line 1 - 8:

- Enter the revenue generated from contributions, gifts, program service revenue, membership dues and assessments, investment income, gross income or loss from sales of assets and inventories, net income or loss from gaming and fundraising events, and other revenues.

-

Line 9:

- Enter the Total Revenue by adding lines 1, 2, 3, 4, 5c, 6d, 7c, and 8.

Expenses (Lines 10 - 17):

Report all the expenses made by your organization during the corresponding

tax year.

-

Line 10 - 16:

- Enter the expenses incurred on grants, benefits provided to members, salaries of your organization’s key personnel, payments made to independent contractors, rent, maintenance costs, the amount spent for publications, and other expenses.

-

Line 17:

- Enter the Total Expenses by adding lines 10

through 16.

- Enter the Total Expenses by adding lines 10

Net Assets (Lines 18 - 21):

Report the value of your organization’s net assets.

-

Lines 18 - 20:

- Enter the value of net assets or fund balances at the beginning of the tax year. If there are any changes in the value between the beginning and end of the tax year, mention it and provide an explanation on Schedule O.

-

Line 21:

- Add the values from lines 18 through 20 to determine the net assets or fund balances at the end of

the tax year.

- Add the values from lines 18 through 20 to determine the net assets or fund balances at the end of

Part II - Balance Sheet

This section requires you to report the required values of assets and liabilities at both the beginning and end of the tax year column.

-

Lines 22 - 24:

- Enter the cash, savings, investments, properties owned by the organization, and other assets.

-

Lines 25 and 26:

- Enter the value of Total Assets and Liabilities.

-

Line 27:

- Enter the value of net assets or fund balances that should match the value of Line 21.

Part III - Statement of Program Service Accomplishments

Program service accomplishments are activities conducted by the organization that serve the organization's exempt purpose. At the top of this part, mention your organization’s primary exempt purpose.

-

Lines 28 - 30:

- Here, you need to describe three of your organization's three largest program service accomplishments during the corresponding

tax year.

- Here, you need to describe three of your organization's three largest program service accomplishments during the corresponding

-

Line 31:

- If your organization conducts any other program services, mention them here and provide a description of them on Schedule O.

-

Line 32:

- Enter the total expenses incurred for program service accomplishments.

Note: For section 501(c)(3) and 501(c)(4) organizations, report these expenses in the Expenses (28a - 31a) column for each program service. For other organizations, this column is optional.

Part IV - List of Officers, Directors, Trustees, and Key Employees

This section includes a table where you need to provide information about individuals who served as Officers, Directors, Trustees, and Key Employees at any time during the tax year.

The details required are:

- Name and title

- Average hours per week

- Compensation (Forms W-2/1099-NEC), if not paid,

enter -0- - Health benefits, contributions to employee benefit plans, and deferred compensation

- Amount of other compensation

What is Form W-2?

Employers use Form W2 to report the wages paid and the Federal and State taxes withheld from the employees’ paychecks to the SSA (Social Security Administration).

What is Form 1099-NEC?

Form 1099-NEC is used to report nonemployee compensation. Payments of $600 or more made to an independent contractor must be reported on

Form 1099-NEC.

Part V - Other Information

This part contains a series of “Yes” or “No” questions about your organization's activities.

-

Lines 33 - 38:

Include any significant activities not previously reported to the IRS and any major changes to the organizing documents.

Additionally, provide details on:

- Unrelated business income of $1,000 or more

- Liquidation, dissolution, termination, or significant disposition of net assets

- Political expenditures

- 1120-POL filing requirements

If the organization has borrowed or made loans to any personnel, indicate “Yes” and attach Form 990

Schedule L. -

Lines 39 and 40:

- Section 501(c)(7) organizations: Must report initiation fees, capital contributions, and gross receipts.

- Section 501(c)(3) organizations: Must report any excise tax imposed during the year under sections 4911, 4912, and 4955.

- Section 501(c)(3), 501(c)(4), and 501(c)(29) organizations: Must indicate if they have engaged in an excess benefit transaction with a disqualified person and provide details on any excise taxes imposed and reimbursed by the organization.

-

Lines 41 - 46:

- Mention the state filing requirements where the copy of this form is submitted.

- Specify where the organization’s books and records are maintained. Report any foreign financial accounts held by the organization.

- Section 4947(a)(1) nonexempt charitable trusts must include the amount of tax-exempt interest earned.

- Indicate if the organization has a controlled entity and is engaged in transactions with it under section 512(b)(13). If “Yes,” attach Form 990 Schedule R.

- Mention if the organization has been involved in any political campaign activities. If “Yes,” attach Form 990 Schedule C.

Part VI - Section 501(c)(3) Organizations Only

As the name indicates, this part needs to be completed only by

Section 501(c)(3) organizations.

-

Lines 47 - 49: (“Yes or “No” questions)

- Indicate if your organization is involved in any lobbying activities.

- If your organization is a school described in section 170(b)(1)(A)(ii), attach Form 990 Schedule E.

- Mention if any transfers were made to an exempt non-charitable related organization.

-

Line 50:

- Provide details for the five highest compensated employees in your organization (excluding officers, directors, trustees, and key employees) who received more than $100,000 in compensation.

-

This information should be presented in a tabular format

(columns a-e) similar

to Part IV. -

Also, indicate the total number of employees who were paid over $100,000

in line f.

-

Line 51:

- Provide the details of the five highest compensated independent contractors in your organization who received more than $100,000 as compensation.

- The required details are the name and business address of each independent contractor(a), type of service (b), compensation (c), and the total number of independent contractors receiving compensation of more than $100,000.

-

Line 52:

- Describe your organization’s Form 990 Schedule A requirement.

Signature and Paid Preparer:

The president, vice president, treasurer, assistant treasurer, chief accounting officer, or other corporate officers who are authorized must sign the return.

If IRS Form 990-EZ is prepared by a paid preparer, their details can be provided.

2. Instructions about Form 990-EZ Schedules

While filing Form 990-EZ, you may need to provide additional information using various Schedules.

The organizations that file Form 990-EZ may be required to provide additional information through various Schedules.

There are 8 Schedules available for Form 990-EZ. Failure to attach the required Schedules could result in incorrect filing and potential IRS penalties.

- Form 990 Schedule A - Public Charity Status and Public Support

- Form 990 Schedule B - Schedule of Contributors

- Form 990 Schedule C - Political Campaign and Lobbying Activities

- Form 990 Schedule E - Schools

- Form 990 Schedule G - Supplemental Information

- Form 990 Schedule L - Transactions with Interested Persons

- Form 990 Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets

- Form 990 Schedule O - Supplemental Information to Form 990

Click here to learn more about the 990-EZ Schedules.

3. How to File 990-EZ electronically?

The Taxpayer First Act mandates that tax-exempt organizationsfile form 990-EZ electronically for a tax year beginning on or after

July 2, 2019.

To ensure a smooth and efficient electronic filing process, consider using a reliable e-file provider.

Get Started with ExpressTaxExempt For a Streamlined Form 990-EZ Filing!

As a leading IRS-authorized e-file provider, ExpressTaxExempt simplifies your Form 990-EZ filing. With our user-friendly features, you can complete your Form 990-EZ quickly and efficiently.

Here is how you can file your Form 990-EZ with ExpressTaxExempt:

-

Step 1: Add Organization Details

Enter your organization's name, EIN, address, and primary officer details. Then select Form 990-EZ for e-filing.

-

Step 2: Choose Tax Year

ExpressTaxExempt supports filings for the current and previous years. Select the tax year for which you need to file Form 990-EZ.

-

Step 3: Complete Form 990-EZ Details

Fill in all necessary details about your organization's revenue, expenses, and other required information in

Form 990-EZ. -

Step 4: Review your Form Information

Thoroughly review all the information you’ve entered to ensure accuracy before proceeding.

-

Step 5: Transmit directly to the IRS

After reviewing, submit IRS Form 990-EZ directly to the IRS.

Article Sources

- IRS Form 990-EZ

- IRS about Form 990-EZ:

- IRS Form 990-EZ instructions: