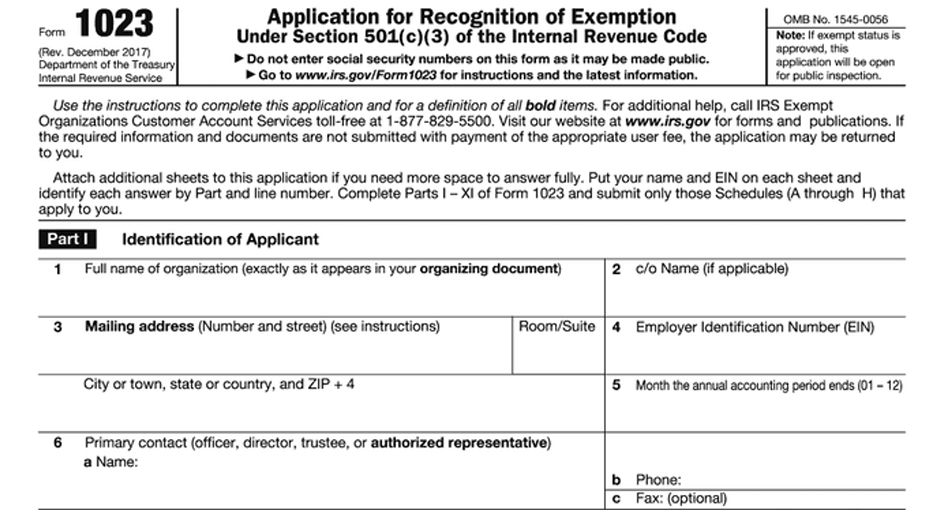

Form 1023: A line by line Instructions

- Updated April 21, 2023 - 8.00 AM - Admin, ExpressTaxExemptEvery Nonprofits and Private Foundations need to file Form 1023 to get TaxExempt status from the IRS under section 501(c)(3).

Form 1023 must be filed after 27 month from the date of formation.

Table of Content

1. Who must file IRS Form 1023?

Organizations that qualify for tax-exempt status under section 501(c)(3) include corporations, limited liability companies (LLCs), unincorporated associations, and trusts must

file Form 1023.

2. When to file Form 1023?

Organizations need to file Form 1023 after 27 months of its formation without failing to get the IRS Tax-exempt status under section 501(c)(3).

3. Instructions to File Form 1023

Filing Form 1023 may be a bit complicated process. We have provided the necessary instructions below that will help you complete the filing process of Form 1023.

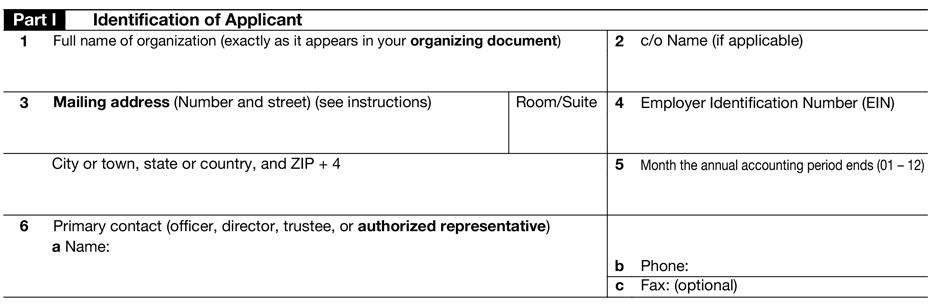

Instructions to complete Form 1023 Part I- Identification of the Applicant

Part I requires the following information about your organization.

- Name of the Organization (exactly as it appears in your organizing document)

- c/o Name (if applicable)

- Mailing Address

- Employer Identification Number (EIN)

- Accounting Period details

- Name of Primary Contact (officer, director, trustee, or authorized representative)

Other details include the CPAs in charge of finances or authorized business custodians, the date the organization was incorporated, EIN, and tax year.

Authorized Representative - A person who is authorized to sign legal documents, complete paperwork, or agree to binding contracts under the authority of your organization, conglomerate, or company. It can also be the person whom you elect to be the point of contact with the IRS.

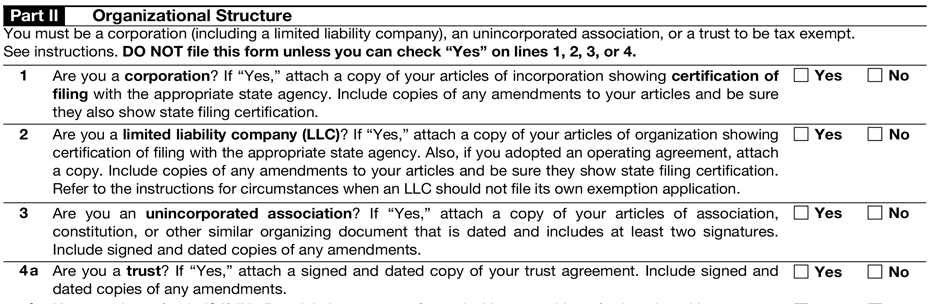

Instructions to complete Form 1023 Part II- Organizational Structure

Part II consists of a set of questionnaires that requires a simple “Yes” or “No” answer. However, you shouldn’t file this form unless you can check “Yes” on lines 1, 2, 3, or 4 of this part.

- If a Trust, is formed by a will, you must submit a copy of the death certificate or a statement indicating the date of death and the relevant portion of the deceased person's will.

- Unincorporated Association, which must have two members who have signed a written document for a specifically designed purpose.

- Corporation, which must have filed its articles of incorporation.

- Limited Liability Company, which must have filed its articles of organization.

- If your organization has bylaws, you must submit the most current copy of them to the IRS. Bylaws are simply the internal rules and regulations of the organization.

If you are filing for tax-exempt status and wish to expedite the request, note that the IRS will only approve the expediting process if the request is made in writing and contains a compelling reason for processing the application more quickly. Circumstances that may warrant an exception include a pending grant or providing imminent disaster relief to victims.

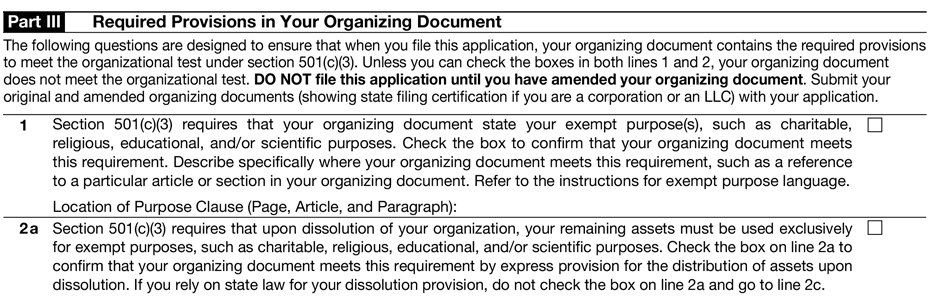

Instructions to complete Form 1023 Part III- Required Province in your Organizing Document

Part III must be completed to ensure that the filing organization has an organizing document that includes a purpose clause and a dissolution clause. The type of organizing document you have will depend on your organization type and may include: articles of incorporation, articles of organization, articles of association, constitution, or trust agreement.

Whatever your organizing document is, it must have the following clause.

- A purpose clause, which outlines the purpose of your organization and is limited to those outlined in section 502(c)(3). Those allowable purposes are: charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

- A dissolution clause, which states that if you should ever disband your organization, all money and other assets must be distributed for an exempt purpose to the Federal Government or a local government for a public purpose.

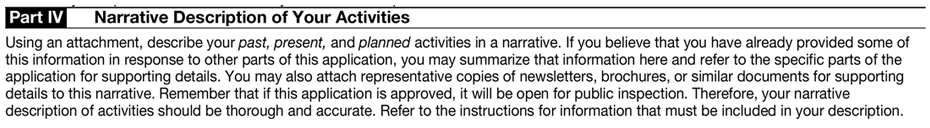

Instructions to complete Form 1023 Part IV- Your Activities

Part IV of Form 1023, or the Narrative Description of your Activities, is the most significant section of your application.

The narrative description of your activities outlines all your organization’s past, present, and future activities. If you have a website, you may attach a paper copy to support your narrative description. However, you shouldn’t repeat what you’ve already stated in your organizing document. Instead, focus on what the specific activity is, who will conduct said activity, when the activity will take place, where the activity is conducted, how the activity is funded, and other such questions related to said activity.

However, you shouldn’t repeat what you’ve already stated in your organizing document.

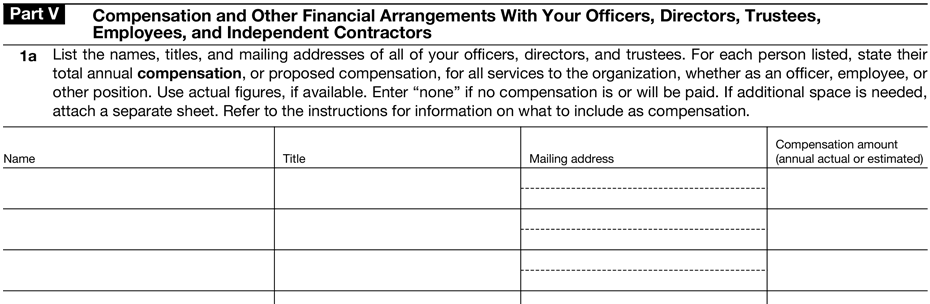

Instructions to complete Form 1023 Part V- Compensation and Other Financial Arrangements

In Part V of your form 1023, the organization’s finances must be clearly outlined and visible when compensating qualified and non-qualified employees.

Compensation encompasses salary, wages, deferred compensation, retirement benefits, fringe benefits, low-interest loans, payment for personal travel, entertainment, athletic or country club membership, personal use of property, bonuses, and other expenses. For each person listed, you must outline their annual compensation and any additional compensation that may occur throughout the year as best you can.

- If an independent contractor makes over $600 in a given year, they must be issued 1099 from the organization.

- If an employee may or will receive more than $50,000 annually in compensations, they are considered a highly compensated employee, and you will need to be prepared to list your five highest compensated employees.

- All other financial decisions, expenses, profits, etc., must also be documented.

Note: A conflict of interest arises when a person in a position of authority benefits from a decision they could make. If such a conflict arises, the person who could benefit must step aside and allow another to decide.

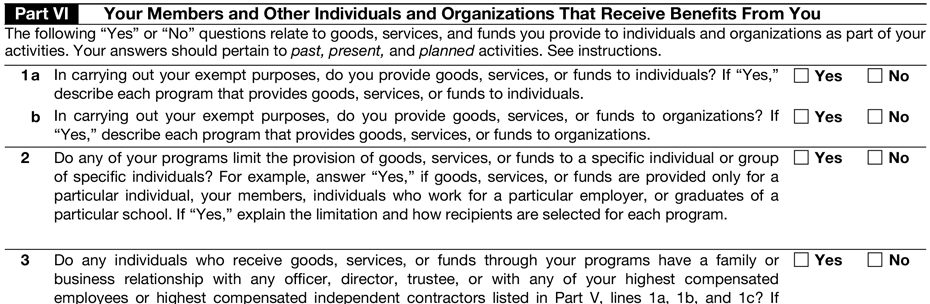

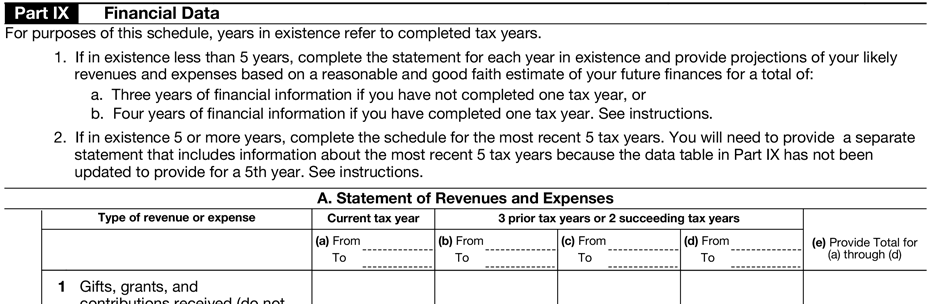

Instructions to complete Form 1023 Part VI- Financial Data

Part VI requires information on the organization’s revenue and expenses for the tax year. This part consists of two sections.

- A. Statement of Revenues and Expenses

- B. Balance Sheet (for your most recently completed tax year) Year End

The balance sheet depicts the financial position of an organization at a specific point in time, eventually at the close of an accounting period. It projects an organization's financial health or net worth at a given time. The balance sheet of a nonprofit organization includes three main sections:

- Assets

- Liabilities

- Fund balance

Organizations must provide the necessary details related to the above sections for the end of the year.

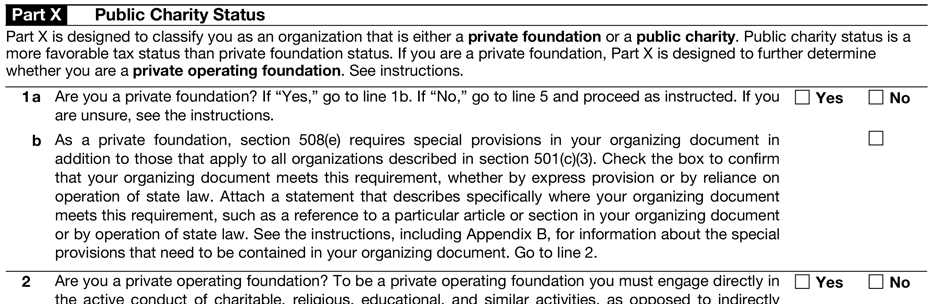

Instructions to complete Form 1023 Part VII- Foundation Classification

By filing Form 1023, you are petitioning the IRS whether you will get all parts of your Federal taxes exempt from paying. And by letting the IRS know about your income and how much you are receiving it, the IRS will categorize you under section 501(c)(3) of the Internal Revenue Code. The sub-categories are

- Public charities

- Private Foundations or Operating Private Foundations

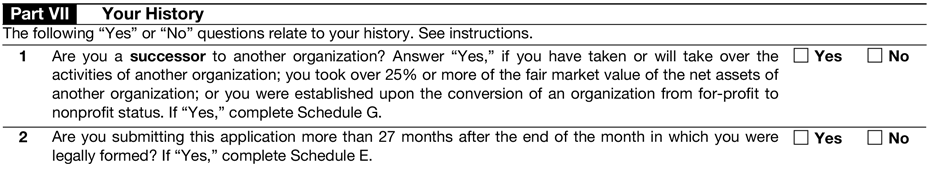

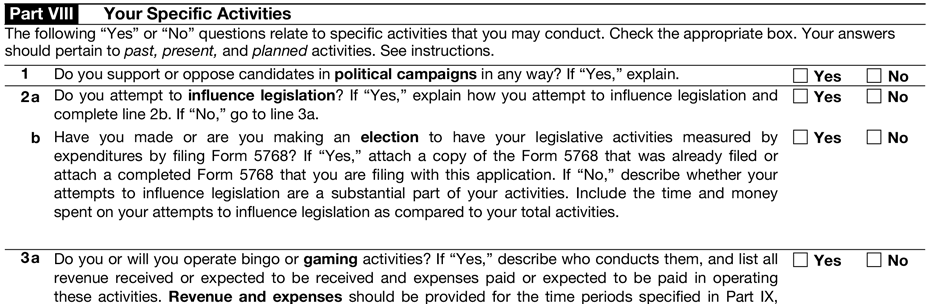

Instructions to complete Form 1023 Part VIII- Effective Date, 27 Month Rule

To complete this part, use the formation date you listed in Part II, line 2, and the date you will submit this electronic form and required user fee payment to determine whether you’re submitting this application within 27 months from the month in which you were formed.

If you’re not submitting this application within 27 months from your formation, complete Schedule E.

Instructions to complete Form 1023 Part IX- Annual Filing Requirement

Most organizations should file an annual return (Form 990, 990-EZ, or Form 990-PF) or notice (Form 990-N, Electronic Notice (e-Postcard)). Based on your gross receipts and assets filing of form 990, returns are classified. If you fail to file the above-mentioned returns for three years continuously, your organization’s exempt status will get automatically revoked.

However, there is an exception to this rule for certain organizations such as churches, certain church affiliated organizations, and certain affiliates of a governmental unit.

Instructions to complete Form 1023 Part X- Signature

An officer, director, trustee, or another authorized official who is authorized to sign must sign the return. The signature must be accompanied by the title or authority of the signer and the date. If the signature is missing, then Form 1023 is not considered by the IRS.

4. How to file Form 1023 electronically?

IRS mandates the electronic filing of Form 1023 online at Pay.gov.

To file Form 1023 electronically, you need to

- Register an account in Pay.gov

- Enter "1023" in the search box and select Form 1023.

- Complete the form and transmit it to the IRS.