Left to file Form 990-T for May 15, 2025.

E-file California Form 199 Online

Securely Prepare and E-file CA Form 199 with ExpressTaxExempt

*You can file CA-199 even if you have filed your 990 return with

other providers.

Why E-File CA Form 199 with ExpressTaxExempt?

- Includes Form 199 Schedule M-1 & L

- Review System for Board Members

- Additional Users to Manage Accounts

- Free First Amendment for original return filed with us.

- Retransmit Rejected Returns for FREE.

- U.S based Chat, Email, & Phone Support

How to e-file CA Form 199?

The Tax990 Commitment: Accepted, Every Time—Nonprofit Tax Filing Made Simple

At Tax990, we’ll do whatever it takes to help you get your form approved.

Retransmit Rejected Returns

If your return is rejected by the IRS due to errors, you can correct and resubmit it at no additional cost.

No Cost Amendments

Found an error after filing? You can file up to 3 amendments without paying extra.

Money-Back Guarantee

If you’re unable to get your form accepted, or it turns out to be a duplicate, we’ll refund your money—no questions asked.

See why our clients choose ExpressTaxExempt!

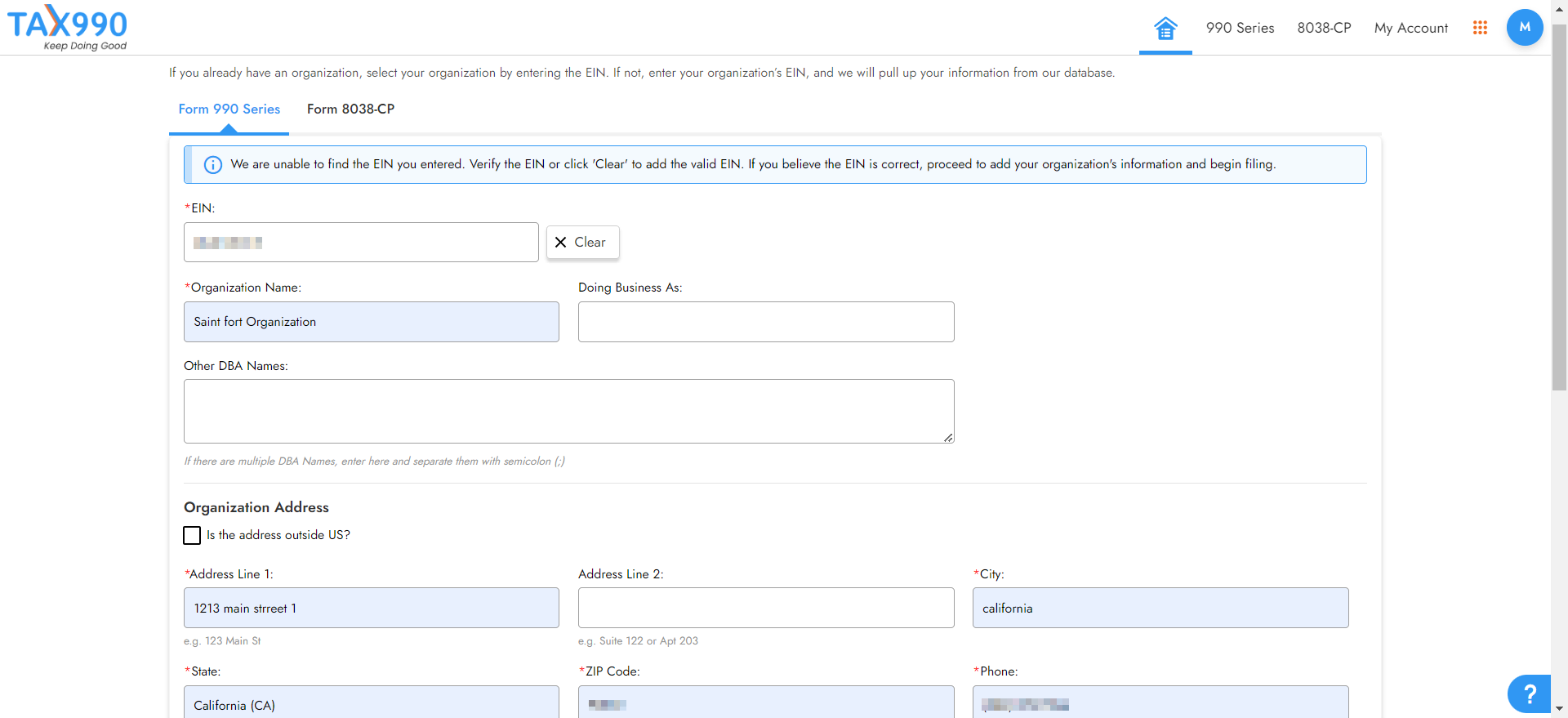

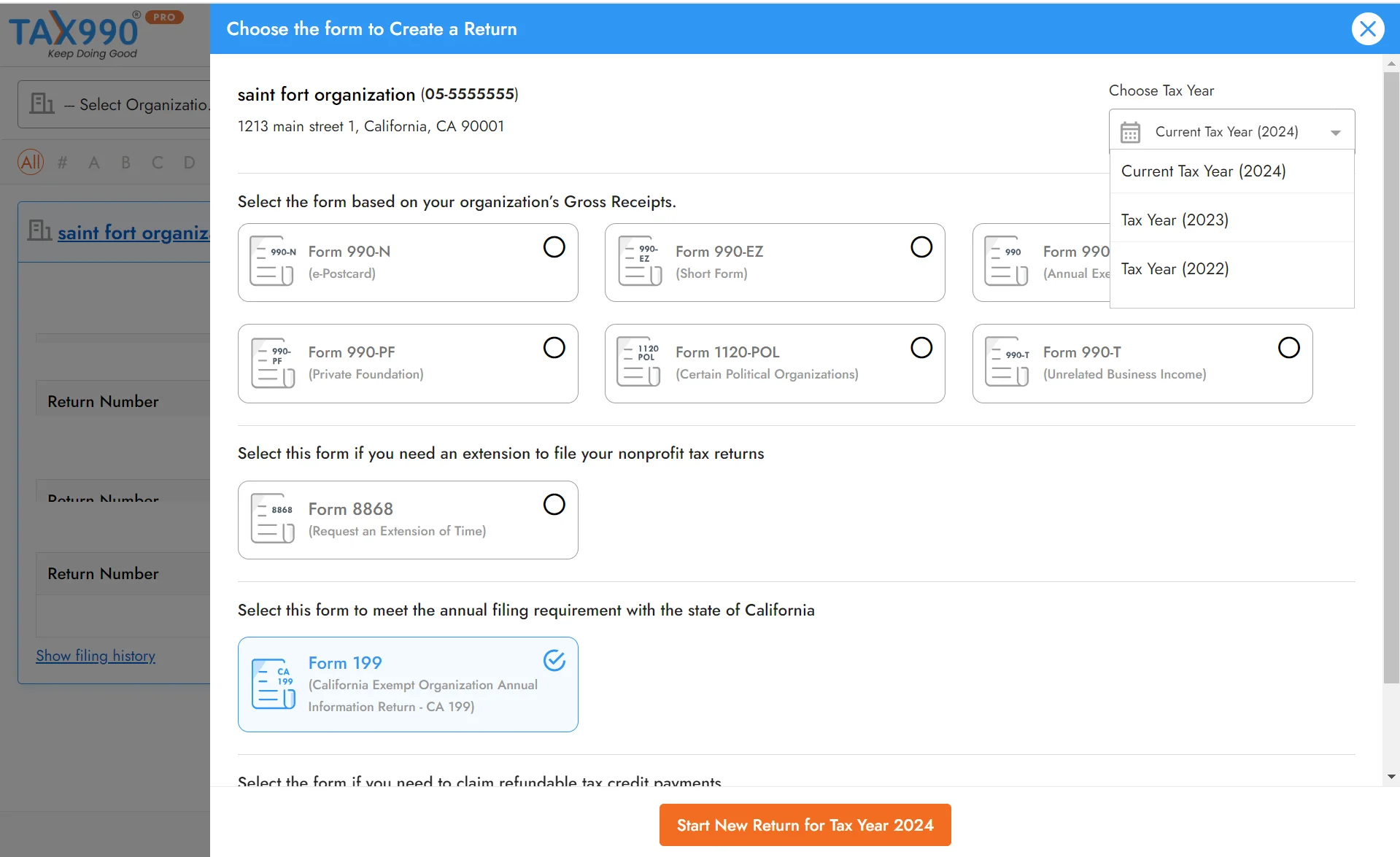

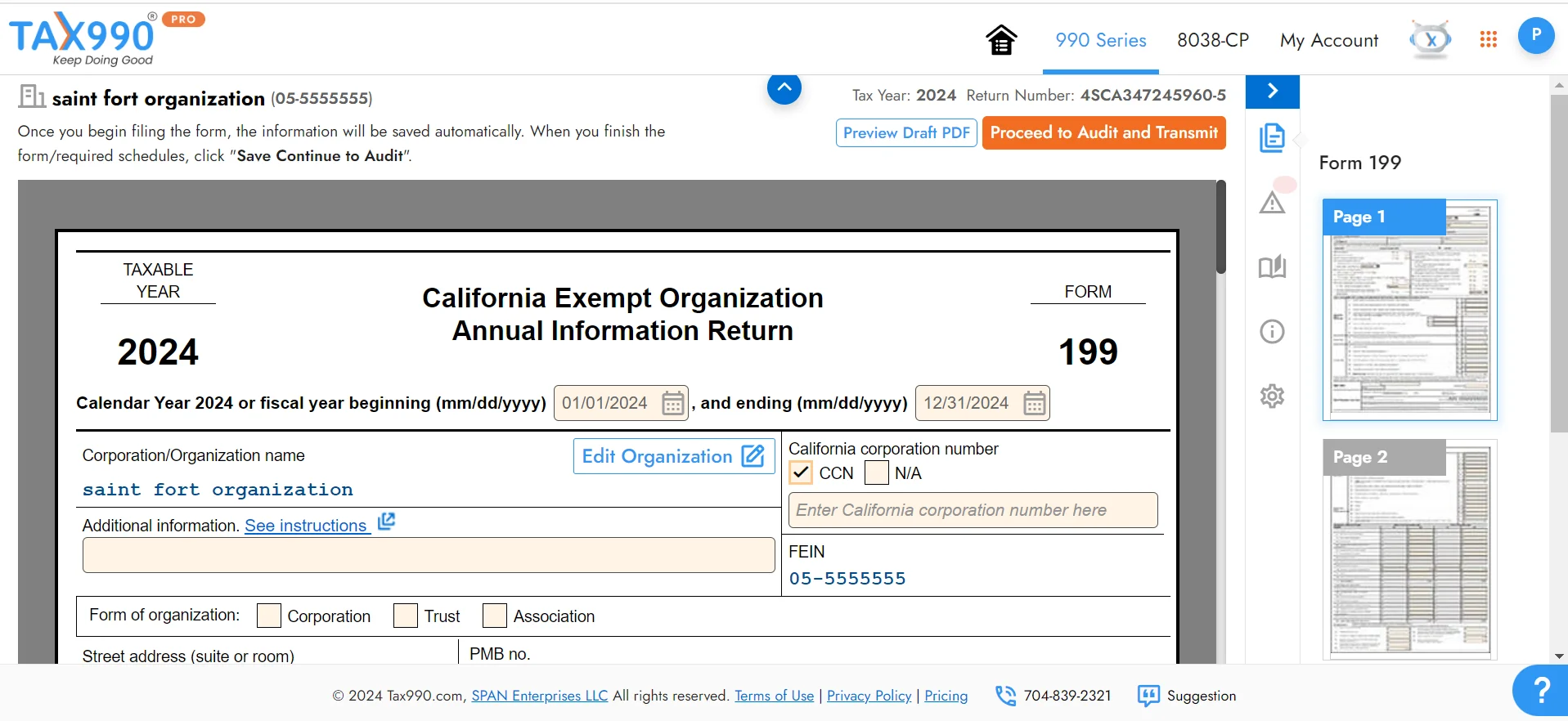

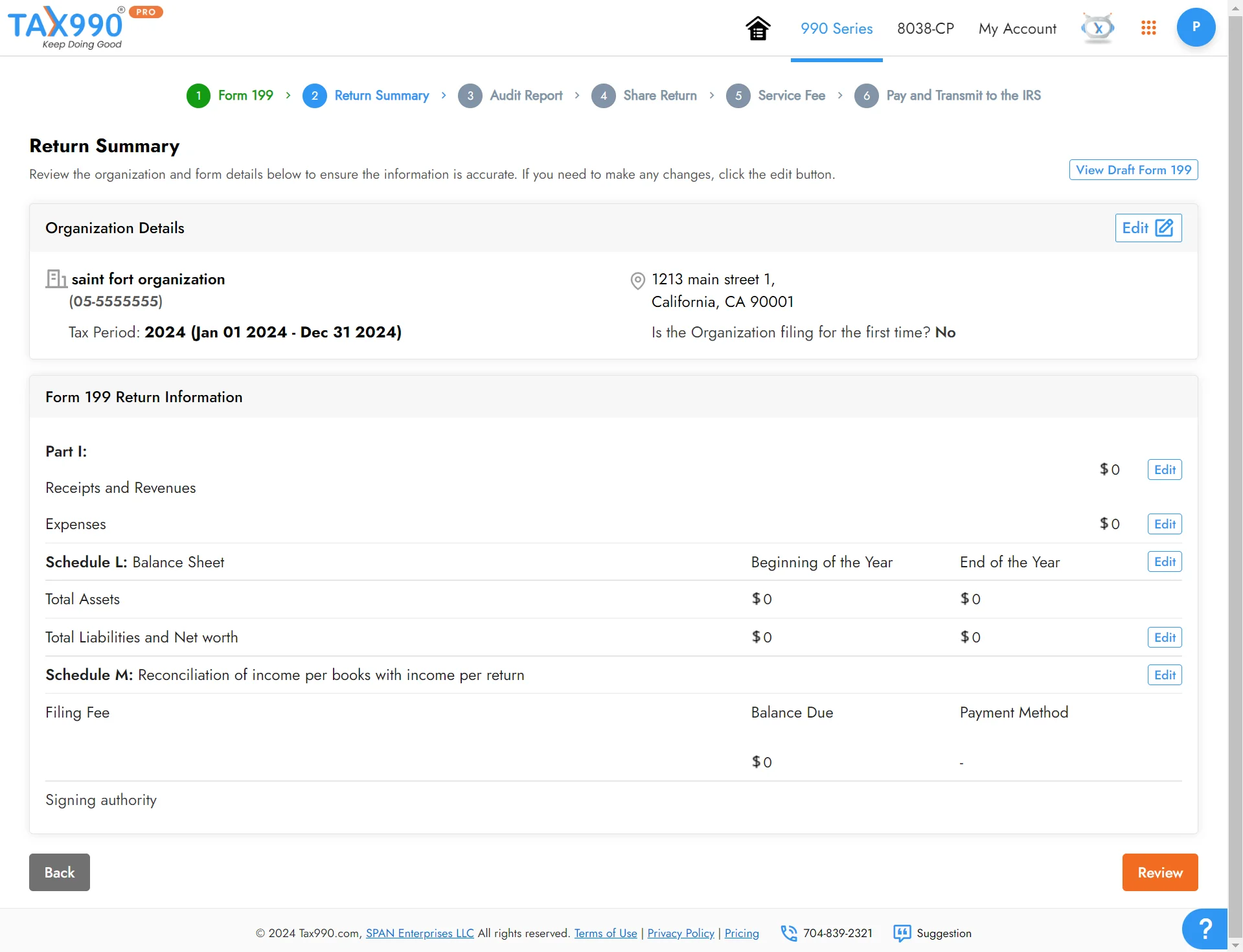

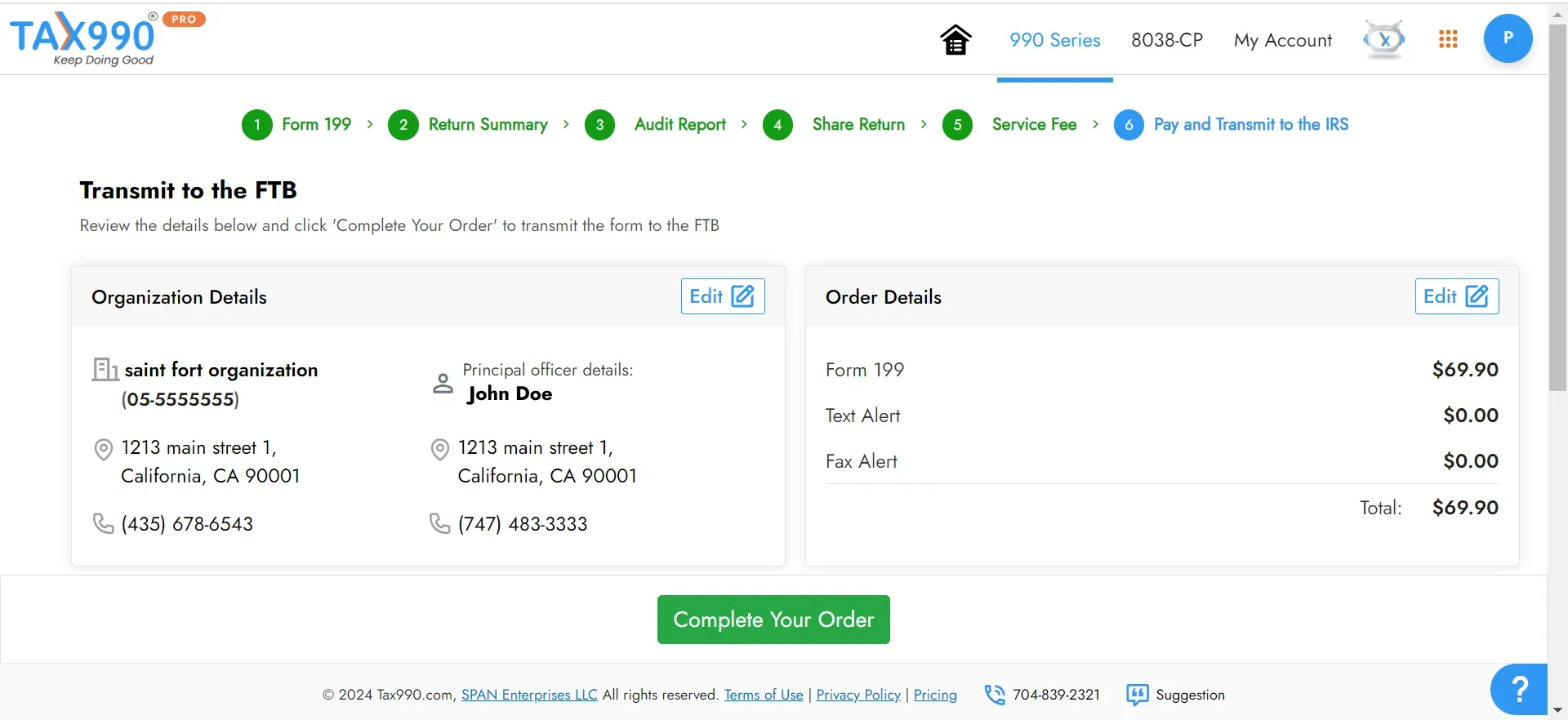

How to E-file CA Form 199 Online for the 2024 Tax Year

with ExpressTaxExempt?

Why E-file CA Form 199 with ExpressTaxExempt?

Prepare Forms using Direct Form Entry

Supports Schedule M-1 & L

Add and Manage Staffs to assist you in Filing

Invite Users to Review and Approve your Return

Re-transmit rejected returns for free

Access to knowledge base, chat, Email, & Phone Support

Form 199 Schedule M-1 and L

- You may need to provide additional information as Schedules along with Form 199.

-

There are 2 Schedules in total available for Form 199 that may need to be attached to the tax return based on particular organizational activities.

- * Schedule M-1 - Balance Sheet

- * Schedule L - Reconciliation of income per books with income per return

- ExpressTaxExempt supports almost every Schedule for Form 199.

Frequently Asked Question on CA Form 199

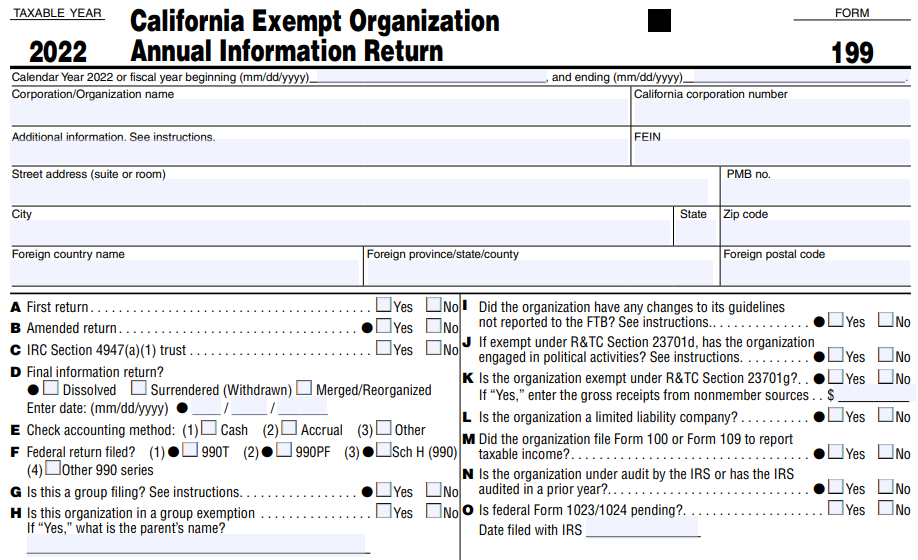

What is Form 199?

Form 199, California Exempt Organization Annual Information Return, is used by the following organizations to report the Receipts and Revenues, Expenses, and Disbursements.

- Organizations granted tax-exempt status by the FTB.

- Nonexempt charitable trusts as described in IRC Section 4947(a)(1).

Note: To file Form 199 with California, you must have your IRS accepted Federal return for your Nonprofit tax Form 990 Series!

Who Must File Form 199?

Nonprofits in California require to file CA state-specific forms to report the basic organization information like expenses, disbursements, filing fees, and more.

| Normal gross receipts | File |

|---|---|

| Gross receipts normally $50,000 or less* | FTB 199N |

| Gross receipts more than $50,000 | Form 199 |

| Private foundations (regardless of gross receipts) | Form 199 |

| Nonexempt charitable trusts described in IRC Section 4947(a)(1) (regardless of gross receipts) | Form 199 |

* Organizations eligible to file FTB 199N may choose to file CA Form 199.

Click here to learn more about Form 199 Filing Requirements

When is the deadline to file my CA Form 199?

The due date for Organizations operating other than the Fiscal year will be the 15th day of the 5th month from when the tax period ends.

If your organization follows the calendar tax year, then the deadline for the 2024 tax year is May 15. E-File Now

How to file Extension for CA Form 199?

If your Nonprofits need more time to file Form 199, the exempt organization has an additional six months to file without filing a written request for an extension.

However, if the Organization that is not in good standing or suspended on the original due date of the nonprofit tax return will not be given an extension of time to file.

Can Form 199 be filed electronically?

Yes, CA Form 199 can be filed electronically using the services of FTB authorized e-file providers such as Tax 990 and also generate the applicable schedules for FREE.

Recent Queries

- I transmitted my federal return to the IRS using your service. Can I file CA Form 199 now?

- Who must file California Exempt Organization Annual Information Return?

- Will I be given an extension of time to file CA Form 199?

- How long does the FTB take to process my CA Form 199?

- How do I know my Form 199 is accepted by the FTB?